3 Valuable Rich Dad Poor Dad Lessons You Should Know

“Cash flow tells the story of how a person handles money.” – Robert T. Kiyosaki

When I was trying to get through dental school and later a surgical residency, the term “financial independence” never crossed my path.

Man, I wish it had instead of “periodontitis” or “osseointegration“. But you have to start somewhere, right?

Speaking of financial freedom, I remember reading The Millionaire Next Door when it was released in 1996. The authors, Thomas J. Stanley and William D. Danko, set out to write a different type of investment book.

Instead of teaching how to become wealthy, the book profiles several people who have already become millionaires.

The first paragraph from the book states, “Twenty years ago we began studying how people become wealthy. Initially, we did it just as you imagine, by surveying people in so-called upscale neighborhoods across the country. In time, we discovered something odd. Many people who live in expensive homes and drive luxury cars do NOT actually have much wealth. Then, we discovered something even odder: Many people who have a great deal of wealth do NOT even live in upscale neighborhoods.”

I Thought Being Rich “Looked” Different

After I read the first part of The Millionaire Next Door before entering dental school, I was confused. There was a part of me that was attracted to the dental profession due to the potential income, but what this book was already telling me was that people I thought were rich (lived in expensive houses and drove fancy cars) may not be as well off as I imagined.

Most Americans, especially doctors, have it all wrong regarding what wealth actually is.

No, wealth does NOT equal income.

Sorry.

I fell for this trap too but it’s not too late to climb out if you’re in the same boat!

I know too many local doctors making great money that lack financial intelligence. They spend their entire income and then some.

They’re failing themselves (and their families) by not focusing on wealth accumulation.

Wealth is what you accumulate and NOT what you spend. This is the #1 reason so many high income professionals have little to show for it.

The Doctor Money Mentality

When doctors and other professionals first join the Passive Investors Circle, I schedule a brief call with them to answer their real estate investing questions and help them develop an investment strategy.

One of the reasons for joining is that they’re confused about the message I’m bringing to the table versus the ones they’ve been taught.

Most doctors think like this about money:

- I hope I don’t run out during retirement.

- I’m in too much debt and spend too much. I’ll NEVER retire early.

- I’ll be stuck in this career whether I continue to like it or not.

- I’ll NEVER be able to take off weeks/months at a time while my kids are still young.

If any of these statements sound like you then no worries, help is on the way!

The first step in succeeding in the financial world starts with how you currently think about money.

You first need to acquire a mindset that helps you:

- attract it

- manage it

- multiply it

For me and thousands of others, Kiyosaki’s book, Rich Dad Poor Dad is one of the best books to help you achieve this mindset.

Rich Dad Poor Dad Summary

One of the reasons that the rich get richer, poor people get poorer, and the middle-class people continues to struggle in debt is because the subject of money is taught at HOME and not school.

Most of us learn about money from our parents.

For those that grow up in a poor household, what can their parents teach them about money? Typically they’re instructed to “stay in school and study hard.”

Unfortunately, these children may graduate with good grades but with a poor person’s financial mindset and continue to suffer with money problems.

Money is NOT taught in schools which explains how smart doctors (and other professionals) struggle financially their entire lives.

After over 25 years of education, I can’t remember learning a single lesson about money (unless you count when a kid stole my money from my locker which taught me NOT to carry cash to school. 🙂 )

This is still very disturbing to me that we’re taught how to perform a skill making money yet don’t learn how to handle it. Maybe this is why so many of us get in over our heads with student loan debt.

In Rich Dad Poor Dad, Kiyosaki shares his story about his “two dads” that taught him about money. Kiyosaki’s biological father or “poor dad” was a college professor while his “rich dad” was his best friend’s dad who happen to be a successful businessman.

His “poor dad” held a Ph.D in education with a steady income, but like many educated people working hard to pay the bills, still struggled with debt and money his entire career.

Kiyosaki’s “rich dad” was a successful business owner (one of the wealthiest in Hawaii) who only had an eighth grade education.

While growing up, he began noticing fundamental differences in both father figures.

“One dad would say: “The love for money is the root of all evil”. The other one, “The LACK of money is the root of all evil”. – Robert Kiyosaki

Kiyosaki stated, “I noticed that my poor dad was poor, not because of the amount of money he earned, which was significant, but because of his thoughts and actions.“

Many doctors also fall into this situation due to their mindset regarding money. Even with substantial incomes, having a scarcity mindset limits them their entire career.

There are six main lessons that Kiyosaki discusses in the book that he learned over a thirty year period from his rich dad.

While all six are important, here’s the three most important for doctors and other high income earners.

“There is a difference between being poor and being broke. Broke is temporary, and poor is eternal.” -Rich Dad Poor Dad

3 Valuable Rich Dad Poor Dad Lessons For Doctors

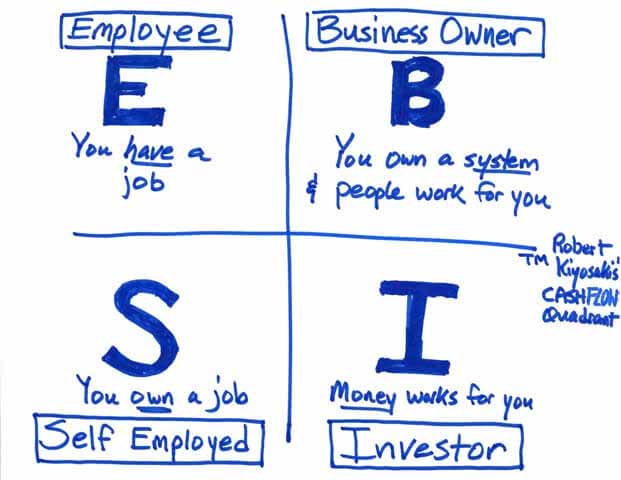

#1 The Cashflow Quadrant

One of the most profound lessons from the book has to do with where our income comes from.

Most doctors never consider this.

Kiyosaki breaks it down into four places or quadrants:

- E – Employee – You have a job

- S – Self-employed – You own a job

- B – Business owner– You own a system and people work for you

- I – Investor – Money works for you

At first glance, I realized that yours truly was on the WRONG SIDE (left side) of the quadrant.

I was shocked!

Here I was, a practice owner (S quadrant), thinking I had it going on until I realized I didn’t.

The last time I felt this shocked was in high school when I found out from Mars Blackmon that it really wasn’t the shoes that made Michael Jordan the best player in the universe!

It’s gotta be the shoes money!!

The Cashflow Quadrant made me realize that I needed to move from the left side of the quadrant to the right as soon as possible,

Why? The book teaches that the left side was set up for the middle class and the right was set up for the wealthy.

Cashflow Quadrant Breakdown

E – Employee

Most of the new doctors complete training and immediately go to work for someone instead of themselves.

Not only is starting a practice from scratch ultra-expensive, but the student loan debt they’re leaving school with is close to $300K on average ($500K $600K for private schools).

Employees must work longer hours for a higher income and continue trading their time for dollars.

S – Self Employed

Self-employed people, like myself, may feel as if they’re in a better situation than the employee but think again.

After it’s all said and done, we’re still in the same boat trading time for money.

Now granted it’s much easier to take deductions when you are self-employed versus being an employee.

Another advantage is being able to hire others to work for you. Typically you’ll pay them less than they’re really helping to bring into your business/practice.

Some portion of their effort and work flows to you as profit.

If though, you theoretically own your own business, in reality the business owns you.

Something else to consider, employees, along with self employed individuals, pay the MOST in taxes.

B – Business Owner

Here’s what Kiyosaki says about the Business Owner category:

“Business owners can take vacations and still make money, and they don’t have to actively work to earn an income.”

Business owners, especially large ones, run a system that produces income independent of their time.

Their employees typically are the ones putting in the majority of the time at work allowing the owner to outsource and delegate responsibilities to others.

A friend of mine owns a medical supply company. I’ve always been envious of his lifestyle as he can take off months at a time and travel with his family.

Most doctors can’t do that.

Business owners are NOT trading time for money, their business generates income whether they’re present or not. What a great feeling to have.

Similar to investors, business owners pay much less in taxes than the employed/self-employed and have much more freedom.

I – Investor

According to Kiyosaki, the B and I quadrants (right side) are where true financial freedom is found.

Investors own assets that make money for them.

This is someone who has earned money (active income) in one or more of the other quadrants and has put that money to work for them creating passive income.

They purchase assets like company shares and real estate that generate cash flow. These types of investments allow doctors to retire much earlier than what they’ve been led to believe.

Reaching this stage makes practicing medicine/dentistry much more enjoyable as you’re working because you WANT to and not because you have to.

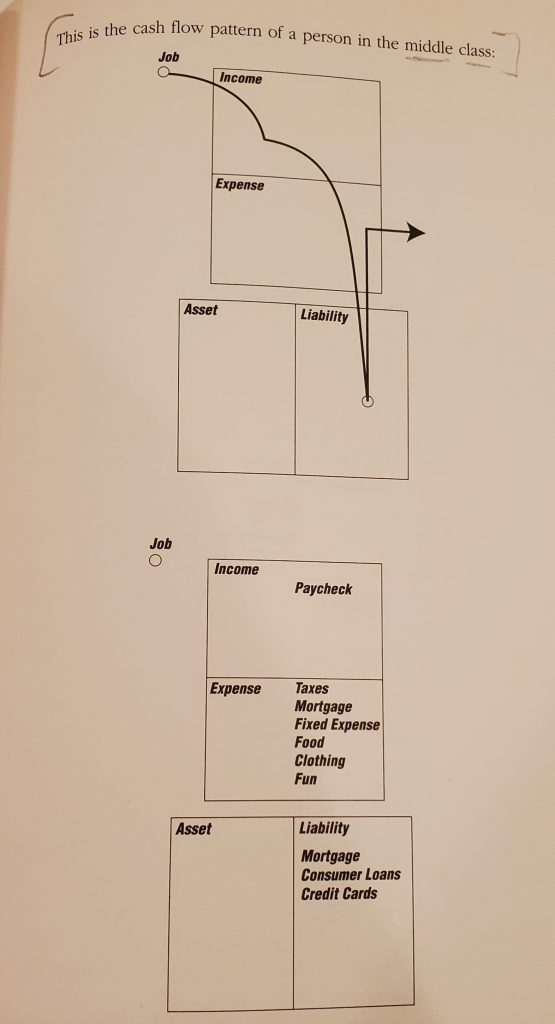

#2 Assets Make Money

One of the most important statements in the book pertained to this lesson, “You must know the difference between an asset and a liability, and buy assets. If you want to be rich, this is all you need to know. It is rule number one. It is the only rule.”

Too many doctors “think” they’re rich because they have expensive cars and big houses but those two categories are why most never grow wealth.

Cars and even houses (unless someone else pays the rent) are considered liabilities by Kiyosaki.

The rich buy assets. The poor and middle class acquire liabilities that they THINK are assets.

Assets put money in our pockets and liabilities take money out.

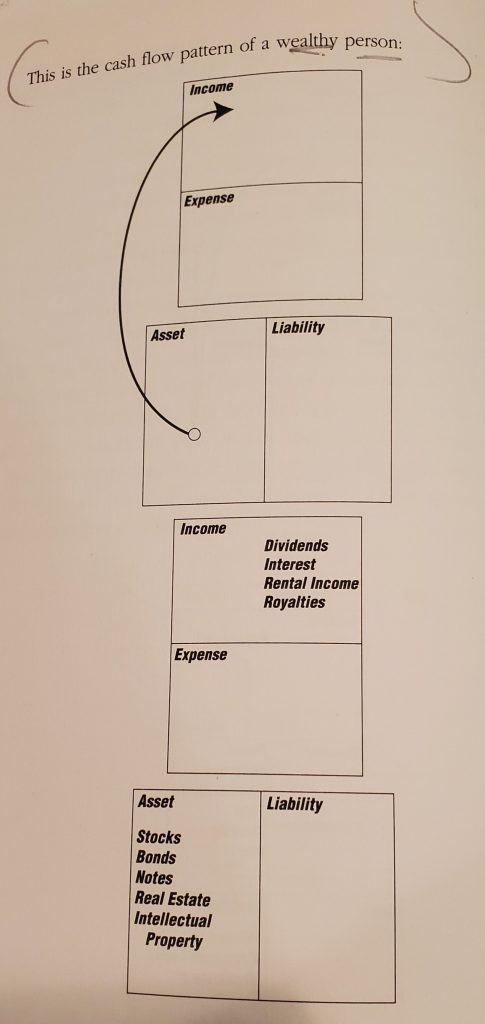

Here’s two diagrams from the Rich Dad Poor Dad book that show this concept visually.

Here’s what the cash flow pattern of the poor or middle class looks like. As money comes in, it immediately goes out to cover the expenses liabilities create.

One of the main examples discussed in the book is our home. We buy one originally thinking it’s an asset that’s going to make us money until we realize it’s not.

Next we see how the cash flow pattern of a rich person flows. The assets (real estate, stocks, etc) create income which goes right back to the person.

Theoretically one could have their assets pay for their liabilities. Hey now that’s new ways to approach finances, right?

We want to make sure we invest to grow our wealth to have enough money. We can do this by investing in things that produce income, appreciate or do both.

“Keep your daytime job, but start buying real assets, not liabilities or personal effects that have no real value once you get them home. Keep expenses low, reduce liabilities, and diligently build a base of solid assets.”

Kiyosaki recommends investing in real estate, mutual funds, stocks, bonds and other small businesses. All of these assets typically have a positive return along with positive cash flow.

He’s REALLY big into real estate investing which both provides cash flow and appreciates the longer you hold it.

As a side note, Kiyosaki states that acquiring a lot of money won’t solve your financial problems if you don’t know how to manage it. It actually makes things worse.

#3 Avoiding the Scarcity Mindset

Another Rich Dad Poor Dad lesson regards avoiding the “Scarcity Mindset.”

We can thank the late Stephen Covey for coining the terms the “scarcity mindset/mentality” and the “abundance mindset/mentality” in his book, The 7 Habits of Highly Effective People.

Scarcity Mindset

Covey states, “Most people are deeply scripted in what I call the Scarcity Mentality. They see life as having only so much, as though there were only one pie out there. And if someone were to get a big piece of the pie, it would mean less for everybody else.”

Those that choose this mindset never feel that their own “personal” pie can ever be grown. It’s of limited size and will continue to stay that way. The only way it can be grown is by taking from someone else.

Unfortunately, this causes suspicion of other people and put the focus more on expenses rather than income (think Mr. Scrooge).

People with a scarcity mindset often have the following thoughts:

- They must hoard resources because there’s only a certain amount to go around.

- Have an extreme fear of change.

- Will only help others ONLY if they receive something in return.

- Competition is more important than collaboration.

- They fear risk which keeps them from progressing to bigger and better opportunities in life.

Needless to say, those with this type of mindset are all about serving their interests ONLY no matter the cost..

It’s all about getting a bigger slice of the pie, no matter the cost to one’s peace of mind.

Abundance Mindset

The opposite of the Scarcity Mindset is the Abundance Mindset. This is where you realize the pie can grow and that there’s MORE than enough for everyone to go around.

People with the ability to think long term vs short term are using an abundance mindset.

They realize that just because you don’t have something NOW doesn’t mean you can’t get it later.

Using this mindset allows one to think that EVERYONE can become more wealthy and there are no limits on your income.

“Don’t live below your means, expand your means.” – Robert Kiyosaki

These people tend to be more content and willing to help others out. They know that it’s not ONLY about themselves.

Related article: Scarcity vs Abundance Mindset – Which Do You Have?

Building Wealth Takes Big Changes

There are several other Rich Dad Poor Dad financial lessons in the book but I felt that these were the BIGGEST for the doctor/high-income professional to start with.

They will help to give you an insight as to how rich people build enormous wealth. All involve making behavioral changes as part of your financial routine.

If you want to improve your financial situation and avoid the rat race, you’ll have to make substantial changes in the way you think about and handle money.

The rich have already figured that out and this book will start you in the right direction.

Join the Passive Investors CircleFAQs

What are the key financial education lessons from Robert T. Kiyosaki’s “Rich Dad Poor Dad”?

This FAQ should address the main financial lessons taught in Kiyosaki’s famous book. Focus on the importance of financial literacy, the concept of having money work for you (as opposed to working for money), and the idea of building assets rather than accumulating liabilities. Mention the contrast between Kiyosaki’s real father and his best friend Mike’s father, illustrating different perspectives on wealth and financial security.

How does “Rich Dad Poor Dad” change the perspective on earning and investing money?

Discuss how Kiyosaki challenges traditional views of earning income through a decent job and investing in the stock market. Emphasize the concepts of earning passive income, looking for creative investment opportunities like rental properties, and understanding financial statements. This should highlight the difference between the middle-class work ethic focused on earned income and the wealthy people’s focus on growing their asset column.

What does “Rich Dad Poor Dad” teach about personal finance and wealth accumulation in the United States?

Highlight Kiyosaki’s insights into the financial practices that lead to great wealth, particularly in the context of the United States. Discuss his views on the middle class struggle, the importance of stepping out of comfort zones, and how smart people use their financial IQ to find different ways to grow rich, like through small businesses or different books of investments.

How can “Rich Dad Poor Dad” impact people’s lives and career paths?

Explore how the lessons from this New York Times best-seller can influence people’s career choices and overall approach to personal finance. Mention the importance of understanding balance sheets and financial statements, and how this knowledge can provide an upper hand in both career and personal asset management. Also, it touches on how the book encourages readers to pursue business ideas and investment opportunities.

What advice does “Rich Dad Poor Dad” offer to young adults about managing finances?

Focus on the advice Kiyosaki gives to younger audiences, especially those just starting on their financial journey. Talk about the significance of taking small steps towards building a solid financial foundation, learning about different investment opportunities, and the importance of diversifying income sources. Mention how Kiyosaki’s lessons can be a guide for young adults to understand the main difference between the way the rich and the middle class handle their finances.