The Dave Ramsey Baby Steps Explained

If you enjoy reading and learning about personal finance, then it’s safe to say you’ve probably heard the name Dave Ramsey.

Since the 90s, Dave Ramsey’s Baby Steps has helped millions of people get out of debt and start them down the path to achieving financial freedom.

No matter how many blogs I read or podcasts I listen to, his name stands out more than others. Why? He understands the motivation people need to get out of debt and has built his empire around this method.

I think the world would be better if we take his example by sharing our failures with others to help them avoid the same mistakes we make.

While in his early 20’s, Dave had owned over a million dollars worth of real estate but lost it all and went bankrupt. He then turned his failure into a multi-million dollar company that started with a radio show.

He’s also a marketing wizard. Early in his career, he wrote the book Financial Peace (then later, Financial Peace Revisited) and offered it for free to his church members.

When he later started his radio show, he used it as a platform to sell both the book and the Dave Ramsey Baby Steps and the rest is history…

His entire focus, then and now, centers around his 7 Baby Steps, and is known for encouraging people to become debt-free.

Whether you agree with him or not, I think most would at least benefit from listening to what he has to say.

My wife and I owe him a debt of gratitude (no pun intended!).

So today, I’d like to give an overview of his 7 Baby Steps.

Dave Ramsey Baby Steps Introduction

The Dave Ramsey Baby Steps are straightforward. They’re simple to understand, but for some, they’re difficult to accomplish.

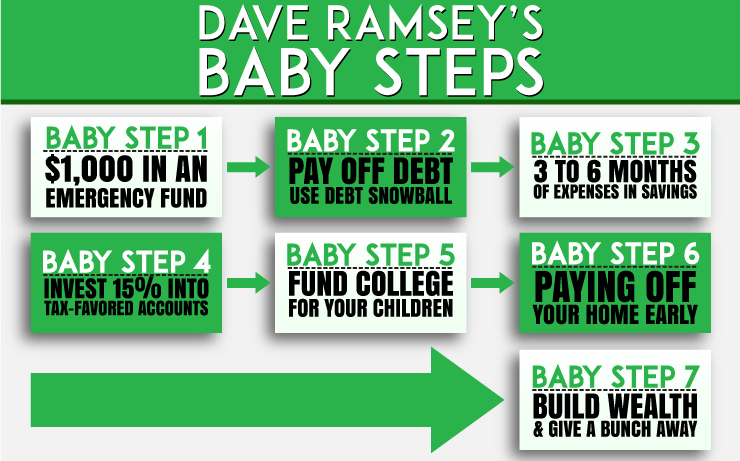

- Step 1: $1,000 in an emergency fund.

- Step 2: Pay off all debt except the house utilizing the debt snowball.

- Step 3: Three to six months of savings in a fully funded emergency fund.

- Step 4: Invest 15% of your household income into Roth IRAs and pre-tax retirement plans.

- Step 5: College Funding (i.e. 529 plan)

- Step 6: Pay off your home early.

- Step 7: Build wealth and give.

For those of you who like visual explanations, here are the baby steps to financial freedom via Well Kept Wallet:

The Breakdown Of Each Step

Dave created a course to help people he called Financial Peace University. You can take it online or find a nearby church that offers it.

His 7-step system is the cornerstone of his course and provides a road map to help people get out of debt and move toward financial freedom.

Here’s a step-by-step breakdown of each from Dave (not New Kids on The Block!).

Step 1: Save $1,000 in an Emergency Fund

Have you ever had something bad happen when you could least afford to? Maybe your A/C unit went out in the heat of the summer or you totaled your car.

There’s a saying that can explain this phenomenon called Murphy’s Law.

It states:

“Anything that can go wrong will go wrong.“

It’s for this reason that Dave recommends starting off by focusing all your attention and energy on saving up $1,000 in an account and labeling it for emergencies only.

This has been the cause of many debates as Dave thinks $1,000 can be enough to ward off most financial disasters, whereas others don’t. I think doctors and other high-income professionals make enough to save more than this, initially somewhere in the $3,000 – $5,000 range.

But I get where he’s coming from. He wants to get people to have a “small” win first to encourage them to continue to the next baby step…

Step 2: Pay Off All Debt Except Your Mortgage

Baby Step 2 is all about psychology. Remember when I mentioned earlier that Dave is a master of getting people motivated to pay off their debt? This step is one of the most important ones that show his power of motivation by using something he calls “The Debt Snowball.”

The Debt Snowball gives people quick wins from the start, just like in Baby Step #1. It keeps people motivated because the majority will stay in this step for several years before getting rid of their consumer debt. The quick wins help keep folks motivated so they can stay the course.

The Debt Snowball method is where you list all of your debts (except the house) from smallest to largest. Next, you make minimum payments on all debts and put every extra dollar you can spare towards the smallest one until it’s gone.

After the smallest is paid off, you move on to the next one on your list. With that one, you add what you were paying on the previous debt + the minimum payment you already paid until it’s paid off. Continue this process with all your debts on the list until you’re consumer debt free.

We created our list on a dry-erase board, which helped keep us even more motivated through the process. Once we paid off a debt, we’d erase it and move on to the next one. We also listed the amount of money we were putting towards them each month, which forced me to want to attempt to add more and more.

There are chemicals in the brain that enhance The Snowball. As you start paying off each loan one by one and the snowball starts growing, it causes the brain to release chemicals whenever you win something, such as dopamine and serotonin. These chemicals cause you to want to continue the process more and more.

Once you’ve completed this step, congratulations! You’re consumer debt-free! It’s now time to move on to Baby Step #3…

Baby Step 3: Finish The Emergency Fund With 3 To 6 Months Of Savings

At this point, you’ve gotten rid of your consumer debt and should have a good chunk of cash to start dispersing elsewhere.

The temptation can be to jump the gun and start retirement investing, funding kid’s college accounts or paying off the house early.

Now, there’s nothing wrong with doing any of those things. And Dave wants us to do them… but after we finish building up our emergency fund with 3 to 6 months of monthly expenses.

He claims that by doing it in this order, we’re reducing the risk of having to go back into debt if we experience an emergency.

How would you handle an emergency if you don’t take his advice?

- Pull money from your retirement account?

- Tap into your kid’s college savings.

Not good choices.

Once you’ve completed this step, you have protected your family with a nice buffer against major financial emergencies.

Baby Step 4: Invest 15% Of Income Into Roth IRAs And Pre-Tax Retirement

Dave gets one of the frequently asked questions regarding this step: “Why is retirement ahead of college funding for our kids?”

Great question. Let’s briefly think through this. It’s natural to want to put our kids ahead of ourselves. I get that as a father. I’d do anything for my kids if it’s for their good (not another X-box, though!).

But what if you end up without sufficient retirement income because you made college funding a higher priority? You’d have to depend on your kids to take care of you. Mine can’t keep their rooms clean, so I want to care for myself!

So before you begin doing anything with the excess money left over from paying off the consumer debt, Dave suggests investing 15% in a retirement account such as a 401(k), Roth IRA, 403(b), or other.

I’ve said this before, and I’ll say this again, high-income professionals should be able to invest at least 20% or more of their gross household income into retirement accounts. If you can’t, that’s not a big deal. But if you can, then that’s just less time it will take to reach financial freedom.

Baby Step 5: College Funding For Kids

By the time you reach this Step, you should:

- have an emergency fund with 3-6 months of expenses

- be debt-free (except a mortgage)

- be investing at least 15% or more of your gross income

Now that you have your finances in order, it’s time to put some money back for the kid’s college. Dave recommends using 529 plans and Coverdell Education Savings Accounts (ESAs). These are tax-advantaged accounts specifically used for educational expenses.

Baby Step 6: Pay Off Your Home Early

At this stage of the game, Dave recommends that you take any extra money coming in after you’ve progressed through the other Baby Steps in order and throw it towards the mortgage.

You’ll hear arguments stating that you should pay off your house early, and those that tell you investing that extra money is the way to go.

The “don’t pay off your mortgage folks” are looking at this strictly from a numbers standpoint. When we paid off our mortgage, we did so more from a psychological point of view.

There was nothing like the feeling of driving up to the house each day, knowing that we owned it. The grass even felt different!

Whenever our family hears talk about how the wealthy are “bad” or the evil “1%” take advantage of people, we remind them of how they got to where they are and of all the good that they do for others.

Our boys are constantly told that being successful in life is going to attract many “haters.” But they should also remember that the MORE money they make, the MORE people they can help.

This leads us to the final Baby Step #7….

Baby Step 7: Build Wealth And Give Generously

If you’ve made it to Baby Step #7, congratulations! You don’t owe anybody anything, and now it’s time to really build wealth and help others. For those of us who make it to this Step, this is what Dave calls your time to “Live and give like no one else.”

It’s also the ending of his book, The Total Money Makeover. It’s what he wants all of his readers to obtain: financial independence, to do whatever we want to do both for ourselves and others.

2 Corinthians 9:11 “You will be enriched in every way so that you can be generous on every occasion, and through us your generosity will result in thanksgiving to God.”

Building Wealth

With no consumer debt, 3-6 months of expenses saved, 15%+ of your income going into retirement accounts, college accounts being funded, and the mortgage paid off, you should have extra money to use to begin building massive amounts of wealth.

To be quite honest, I haven’t given the “building wealth” instruction he gives much thought. But the more I think about it, the more I realize that the sky’s the limit whenever you reach this point in your life.

He mentions investing in both mutual funds and real estate. Don’t forget about setting up and funding a Health Savings Account (HSA) and using its triple tax advantage.

I also recommend that you pay your medical expenses out of pocket and let the HSA grow to use it as another form of retirement account.

After maxing out our retirement accounts, we funnel extra money into real estate via apartment syndications.

To learn more, check out this video:

Something else to consider is creating multiple passive income sources via side hustles.

One of the reasons I started this blog was to keep others from making the same financial mistakes I’d made in the past. This is a perfect example of starting a side gig that you have some type of interest in.

Giving

Dennis Swanberg, motivational speaker and comedian, recently spoke at our church. This guy was hilarious! His message was centered around 2 Timothy 1:16-18, specifically about how we should “refresh” others with whatever we have to offer.

This could be with money, our time, resources, or whatever God has blessed us with.

“May the Lord show mercy to the household of Onesiphorus, because he often refreshed me and was not ashamed of my chains. On the contrary, when he was in Rome, he searched hard for me until he found me. May the Lord grant that he will find mercy from the Lord on that day! You know very well in how many ways he helped me in Ephesus.” – 2 Timothy 1:16-18

Here’s another area in the Bible regarding refreshing others:

Proverbs 11:25 states, “A generous person will prosper; whoever refreshes others will be refreshed.”

Why do I bring this up? When you’ve arrived at Baby Step #7, Dave suggests giving generously and we can do so by refreshing others.

Do you know someone who is always tired, living paycheck to paycheck? Do you know any single moms who could use some help? How about an elderly person who could use some help with yard work or groceries? Can you cook them a meal or mow their yard?

There are so many people who go around overwhelmed and need help daily, but God wants both them and you to prosper.

Many successful athletes tell stories about how others helped them along the way when they were down in life, and then they go on to help underserved youth to inspire them to win in life.

Once you complete the Baby Steps, consider living a life of generosity. As you do, you won’t regret it.

Now that I’ve begun my passive income journey, I started branching off to different options about finances and debt. Check out this video:

Don’t Miss Any Updates. Each week I’ll send you advice on how to reach financial independence with passive income from real estate.

Sign up for my newsletter