A wrist injury while snow skiing was the catalyst that eventually led me to real estate investing. This event showed me that I was relying only on my dental income to support my family. In order to mitigate risk, acquiring additional income streams from real estate seemed to be the way to go.

But little did I know I was in for a big surprise. Once I started investing, I had no idea of the many tax advantages that real estate offers.

If you’ve been looking for ways to reduce your tax liabilities, here are the 7 best real estate investing tax strategies for high-income professionals.

Don’t Miss Any Updates. Each week I’ll send you advice on how to reach financial independence with passive income from real estate.

Sign up for my newsletter7 Top Real Estate Investing Tax Strategies

#1. 1031 exchange

One of the most well-known real estate investing tax strategies is the 1031 exchange.

The 1031 Exchange strategy gets its name from section 1031 of the IRS Code. It allows investors to “defer” paying capital gains tax on an investment property when it’s sold.

The IRS states, “Whenever you sell business or investment property and have a gain, you generally have to pay tax on the gain at the time of sale. IRC Section 1031 provides an exception and allows you to postpone paying tax on the gain if you reinvest the proceeds in similar property as part of a qualifying like-kind exchange.”

The catch is that another “like-kind property” must be purchased with the profit gained by the sale of the first property following a strict timeline (see below).

1031 exchange timeline

In order to benefit from this rule, the IRS states that a specific timeline must be followed:

1) Exchange (sell) one investment property for another (like-kind). It must be real estate for real estate.

2) The property replacing the original property must be of equal or greater value.

3) Here’s where we get into the rules of the 1031 exchange timeline.

- Timeline #1 – You have 45 days after you sell your property to identify up to 3 new properties. This can be done in writing, but you must purchase one or more of them.

- Timeline #2 – You have 180 days to close on one or more of the three properties that were identified.

4) An intermediary has to be involved in order to assist with the process. This means that all the funds must go through a neutral party.

5) After agreeing on a sales price, your intermediary must wire the capital gains to the title holder/company.

6) Complete IRS form 8824.

1031 exchange example

Dr. Y didn’t want to waste money on renting an apartment for his son while he attended LSU. Instead, he decided to buy a small apartment building which allowed his son’s friends to pay the note (smart guy).

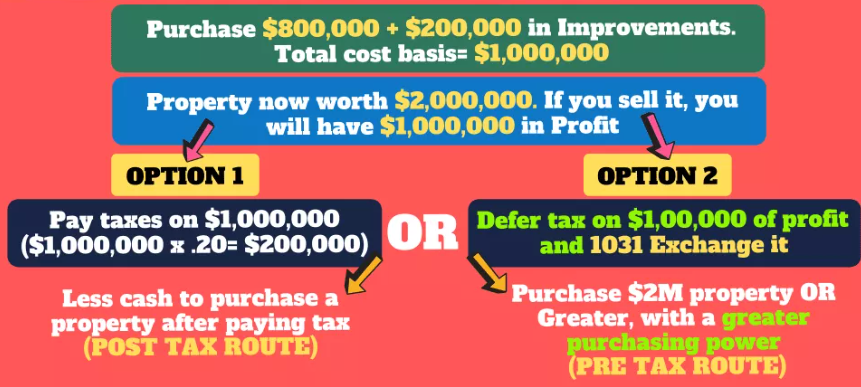

He purchased a five plex for $800,000 and ended up making $200,000 in capital improvements. In other words, he was all in for $1M.

It took his son a little bit longer to graduate (5 years) but the property is now worth $2M ($1M profit). In this situation, the IRS would take 20% of the profits for capital gains taxation ($200k). In order to defer taxes and maintain a greater purchasing power by rolling all of the income into another deal, Dr. Y chooses to 1031 exchange the property into another income producing property.

He rolls over and exchanges the $1,000,000 instead of the $800,000 ($1,000,000 profit – $200,000 capital gains taxes) in after-tax profit.

Remember, he’s now on a timeline to perform the exchange. This means within 45 days, he has to find another multifamily property with a value of at least $2,000,000. Next, he must close on one of the identified properties within 180 days through a qualified intermediary.

If this timeline isn’t met, he’ll be required to pay a capital gains tax of $200,000.

#2. Depreciation

Depreciation is one of the most powerful wealth building tools in real estate as the IRS allows you to write off the value of an asset over time.

Even though commercial real estate usually appreciates over time, the IRS allows you to depreciate its value called a paper or phantom loss.

You can subtract the losses against the income which will REDUCE your tax bill but not affect the cash flow.

Each asset that’s used in business has a useful life of which its cost must be depreciated over. Residential rental property has a 27.5 year useful life while commercial property has a useful life of 39 years.

Let’s take a closer look at depreciation….

a. Straight-line depreciation

Straight-line depreciation is one example that the IRS allow owners of resident occupied real estate to depreciate their property over 27.5 years.

An example would be a property with an improvement value (excluding the land as it can’t be depreciated) of $2.75 million. This scenario would yield $100,000 in depreciation each year over the next 27.5 years.

($2.75 million/ 27.5 years = $100,000)

b. Accelerated depreciation

There’s good news for those that don’t want to wait 27.5 years to benefit. If you hire an engineering firm to perform a cost segregation study, then you’re able to front load or accelerate the depreciation process.

Items can be depreciated over shorter time schedules of 5, 7, and 15 years by identifying all the non-structural elements of the property along with any land improvements.

This is great as most of us passive investors are investing in deals with a 5-7 year hold time.

c. Bonus depreciation

Bonus depreciation is a form of accelerated depreciation that allows you to take the benefit in the FIRST year instead of over the 5,7 or 15 year schedule.

The Tax Cuts and Jobs Act in 2017 was passed that stated if property was or is purchased after September 27, 2017, and before January 1, 2023 then you can get a first year 100% benefit.

Unfortunately, this benefit gets phased out by 20% each year through 2027.

Related article: Bonus Depreciation is Phasing Out – Here’s What You Should Know

Two critical points

There are two critical points to remember regarding depreciation:

Point #1 – The IRS mandates that you take it. Many real estate investors don’t want to take a depreciation deduction because of the depreciation recapture tax that’s imposed once the property is sold. The IRS implemented this to “recapture” the taxes that would have been paid over the years without the benefit of claiming depreciation.

Point #2 – It tracks deterioration. Depreciation is meant to track a property’s deterioration over time. You’re given a tax deduction each year because you paid upfront for the property. This is one of the few “thank you” gifts from the IRS for providing housing to others.

#3. Business Tax Deductions

If you’re either an active investor or claim real estate professional status, then you’ll be able to deduct business expenses associated with the operation of your property.

Even though the IRS allows investors to write off several expenses; not everything can be written off. The expenses must be both ordinary and necessary to be written off.

According to the IRS, “An ordinary expense is one that is common and accepted in your trade or business. A necessary expense is one that is helpful and appropriate for your trade or business.”

TheRealEstateCPA.com states that deductible business expenses must meet the following tests:

- The expense is ordinary and necessary. (Ex: A watch dog may be necessary, but probably not ordinary.

- The expense is current. It provides a benefit now such as advertising for tenants, rather than a longer-term benefit (i.e. a new roof).

- The expense is directly related to your real estate activity. If you want to deduct travel expenses while on vacation, then you must be able to prove it’s related to your real estate business.

- The amount of the expense is reasonable. Is the $300 steak reasonable?

Some of the expenses that can be deducted which are tied to the operation, management and maintenance of your property include:

- Property taxes

- Advertising

- Business equipment

- Property insurance

- Mortgage interest

- Management fees

- Cost to maintain and repair the building

The goal is to have these deductions lessen your taxable income which ultimately lowers your tax burden.

Example: Let’s assume that you own a rental which the tenant pays $2k/month or $24,000/year. If the deductible expenses are $7,000, this means the taxable income from your real estate business is now $17,000.

#4. The 20% Pass Through Deduction

One of the benefits from the 2017 Tax Cuts and Jobs Act was that it created a pass-through business income deduction. According to the IRS.gov website, this allows eligible self-employed and small-business owners to deduct up to 20% of their qualified business income (QBI), plus up to 20% of qualified real estate investment trust (REIT) dividends and qualified publicly traded partnership (PTP) income on their taxes.

Business owners that are sole proprietors, LLCs, and S-Corps with taxable income less than $170,050 ($340,100 if married filing jointly) will be able to deduct 20% of their qualified business income.

For example, if you have a business with net operating income of $100,000 and W-2 wages of $100,000, you will be able to deduct $20,000 from your net operating income ($100,000 x 20%).

If you’re over the income limit, complicated IRS rules determine whether your business income qualifies for a full or partial deduction. Make sure you use the services of qualified CPA for help with this and other tax issues.

#5. Capital gains advantage

If you’ve made money investing, whether in the market, real estate or any trading any asset, then there’s good news and bad news.

The good news is…you made money!

The bad news is you made money which means the good ‘ole IRS is going to want a cut of your gains as well. If you’ve made money on an investment in a taxable account, then you’ve earned a capital gain which means you’ll have to pay capital gains tax on it.

Basically, this is a tax levied on the profits realized when an investor sells their assets for more than the original purchase price.

Your total income and how long you’ve held those assets determines how much you pay. There are two types to be aware of that impact your tax situation differently:

- short-term capital gains tax

- long-term capital gains tax

Short-term capital gains

You realize a short-term capital gain when you profit from selling an asset less than a year of owning it.

Even though you may be in a situation where you don’t have a choice but to sell, you’ll need to be aware that doing so can have a negative effect on your taxes. That’s because the gain gets counted as ordinary income.

Long-term capital gains

If you profit from the sale of an asset held for more than a year, you’ll pay a long-term capital gains tax.

By doing so, you’ll keep more money versus holding it for less than a year as this tax has a significantly lower tax rate than your standard income.

Depending on if your income is low enough, you may not have to pay the tax at all. The long-term capital gains tax rates are 0 percent, 15 percent and 20 percent, depending on your income.

#6. Invest in a self-directed IRA

More than likely you’re familiar with investing in stocks, bonds and mutual funds via IRAs and Roth IRAs. These are well known retirement vehicles that allow individuals to invest in a tax-deferred way.

Occasionally people want other options to invest (besides the stock market) yet don’t know what else to do. Introducing the self-directed IRA (SDIRA).

This is an individual retirement account (IRA) in which the investor is in charge of making all the investment decisions (instead of your financial advisor).

The main difference between a SDIRA and a Roth or Traditional IRA is that it provides the investor with greater opportunity for asset diversification outside of the traditional stocks, bonds, and mutual funds.

For example, funds in a SDIRA can be used for:

- Real estate

- Undeveloped or raw land

- Promissory notes

- Tax lien certificates

- Gold, silver and other precious metals

- Water rights

- Mineral rights, oil and gas

What you may not know is that you can set up your own self-directed IRA and use it to invest in real estate tax-free.

First, you’ll need a trustee custodian to administer the account. This would be a bank, or other entity approved by the Internal Revenue Service, not an individual. They’re responsible for record keeping and IRS reporting requirements.

When this new account is set up, it’ll have a new name and an account number. Once you select the property that you want the IRA to purchase, then the purchase contract, title, etc. are all in the name of the IRA.

In essence, SDIRA investors can fund real estate purchases with the funds from their IRAs without being penalized if the profits are returned to the same account from which they came.

This gives 2 main benefits:

- gives investor the money to secure rental property

- funds that go back into the account get the same differential tax treatment synonymous with IRAs

#7. Investing in real estate syndications

A real estate syndication is the pooling of funds from a group of investors to form a partnership in order to purchase a property (i.e. apartment complex, self storage, etc.) that’s more expensive than any could have afforded on their own.

So instead of buying several smaller individual commercial properties, the group can buy a larger asset together. Usually a limited liability company (LLC) is formed, and investors own a share of the LLC.

The majority of these deals are only available to someone that qualifies as an accredited investor.

Syndication structure

The typical syndication structure involves an LLC for the property that’s owned by two groups:

- general partners

- limited partners

The general partners (sponsor) play the most critical role in the investment process.

This group is involved with:

- finding the investment property

- obtain financing

- acquisition process

- management

They’re granted a stake in the LLC as they’re the ones that perform all the hard work of forming the deal and will be responsible for operations during the hold period.

The limited partners (passive investors) are individuals that supply capital for the deal. They have no active responsibilities in managing the asset and typically take an ownership stake in the LLC based on their initial investment.

Investing in a syndication as a limited partner can be a key tax reduction strategy along with a way to develop additional passive income streams.

Tax losses can also be claimed using limited partner investments (I’ve been doing it for 7 years with my qualified CPA). This can be done due to the general partners typically order cost segregation studies. This allows the limited partners to receive large passive losses during the first few years of ownership.

I can’t stress enough the importance of having a good CPA on your team with thorough real estate knowledge to assist if you decide to invest in real estate.

To learn more about real estate syndication structures, check out the video below:

Join the Passive Investors CircleFrequently Asked Questions

As previously discussed, one of the top strategies that real estate investors can take advantage of to lower their taxable income is via through depreciation or through a tax deferral status such as a 1031 exchange.

The two main tax benefits of owning rental properties include being able to utilize the “paper losses” from depreciating the property to shelter taxable income and through 1031 exchanges that allow real estate investors to defer capital gains tax and roll over their profits into larger real estate assets.

How does the IRS know if I have rental income?

There are several ways the IRS can find out if an individual is receiving income from rental property including:

- routing tax audits

- public records

- real estate paperwork

Those who don’t report rental income may be subject to accuracy-related penalties, civil fraud penalties, and criminal charges.