10 Pros And Cons Of Owning An Apartment Building

It takes a lot of time and sacrifice to become a doctor. If you’ve been practicing for a while, it’s easy to forget how many years that were put in to get to where you are.

Whenever new investors from our Passive Investors Circle group ask about the best way they can get into investing in rental properties, such as apartment ownership, I have to remind them about their career path.

You’ve gotten to where you are because of the knowledge, skill and training acquired along the way. Depending on your profession, this can be anywhere from 4-12+ years post college.

When I look back at my path, it’s hard to believe I put in 8 extra years of training after college. I have to remind others that want to get into real estate investing that just because we’ve acquired a lot of education, it doesn’t mean we’ll automatically be successful with investing.

Those that want to jump in head first without doing a lot of the hard work that’s needed to be successful in real estate investments are setting themselves up for failure on Day One.

If you’re a regular visitor of this blog (thank you!) then you know that it’s no secret that I believe that owning property is one of the best ways to build wealth and eventually achieving financial independence.

As someone that has been a part of several multifamily apartment syndication deals, I understand what it’s like to experience the great array of benefits including:

- cash flow (passive income)

- tax benefits (depreciation)

- financial security

- leverage

- diversification

- appreciation

However, investing in apartment complexes isn’t always as great as it’s cracked up to be. There are several pros and cons to owning an apartment building that you should know especially if you’re a busy professional.

This list is mainly for the passive investor that’s putting in the hard work at their 9-5 with no time (or desire) to be a landlord.

Don’t Miss Any Updates. Each week I’ll send you advice on how to reach financial independence with passive income from real estate.

Sign up for my newsletterPros Of Owning An Apartment Building

Pro #1. Passive income (+ cash flow)

Whether you’re a passive investor in a syndication or the sole owner of an apartment building, passive income is one of the main reasons to invest.

Investors are able to benefit from multiple streams of income.

Earning positive cash flow ultimately comes from tenants paying rent which is based on the property’s NOI (net operating income).

NOI is the income leftover after all of the expenses are paid.

The monthly rental income can increase over time depending on the number of units that are improved which allows rents to be increased.

Pro #2. Economy of scale and efficiency

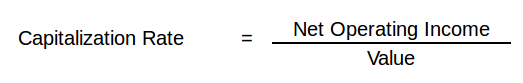

Most cap rates are calculated by taking the net operating income and dividing it by the market value(purchase price).

If we change the variable around, we can determine the value increase:

Value of the property = NOI/Cap Rate

In the above example, Value = $30,000/5%

The small raise in monthly rent caused the entire building value to increase a whopping $600,000!

Try accomplishing that with single-family property.

Renovating commercial real estate and slightly bumping the rents is the easiest way to increase the value significantly.

Pro #3. Tax benefits

One of the top advantages apartment owners have is the tax benefits. An example is the ability to deduct maintenance costs and operating expenses associated with the building (advertising, payroll, property taxes, painting, property manager fees, etc.) and depreciate the building’s value.

Also, if you use a cost segregation study, you can accelerate the depreciation schedule for even greater savings.

Pro #4. Lower risk exposure

One of the biggest issues single-family property owners face is when their tenant moves out and vacancy rates increase. Not only does the property sit empty, but you have to continue paying marketing costs to get it leased again.

And depending on the location and local job market, this could be a daunting task.

When you have multiple tenants in one apartment building, you’re spreading out both your risk and cost for vacancies.

As a father of two teenage boys (that eat us out of the house), I look for lower risk property (i.e. older apartment buildings) such as it being in a location of incredible growth and has a proven track record of a high occupancy rate.

I want something that will be cash flowing from day one.

Now the returns might not be as good as a new construction deal, but I’ll take that with the lower risk vs having to worry about the deal going south.

Pro #5. Control on property appreciation and value

There’s a difference in how a single-family home is valued versus apartment buildings.

Typically homes are valued based on “comps” or the comparable home sales within the area it’s located.

On the other hand, the value of apartment buildings are determined by the income they produce in relation to other apartment buildings in the area.

Apartment building owners can increase the NOI by adding value (covered parking, internet/cable/satellite, laundry services, etc.) or by decreasing the expenses.

Now let’s get into the downsides of owning an apartment building.

Join the Passive Investors CircleCons Of Owning An Apartment Building

Like anything in life, there’s no good without bad. Owning an apartment building comes with a cost but fortunately there are ways to minimize them.

Con #1. Property management

To keep on track for doing what you do best (your day job), finding a good investment property management company is a must.

This can involve them taking care of:

- maintenance issues

- collecting rent

- background checks for new tenants

- landscaping

- advertising for vacancies

If you don’t have much money to hire someone, you’ll have to do it yourself.

Fortunately, passive investors in syndications have the property management taken care of via the sponsors of the deal.

The syndicator will handle or manage all of the property management issues.

Con #2. Local market factors

I learned this lesson the HARD way when I invested (and lost) $50K with Realty Shares via crowdfunding.

Unfortunately, when investing through a website, you don’t to get an opportunity to meet the sponsors which makes performing due diligence tough.

If I’m investing my hard-earned money, I want to know who’s going to be taking care of it.

Even though I was investing in a great location (Tulsa, OK), the neighborhood started to go downhill quickly with crime causing more tenants to leave than expected.

Although we may think we’re investing in an apartment in a good, safe location, no one can predict the future.

You never can tell what the rental market might do.

Con #3. Vacancies and tenant issues

Even though your tenants will be providing the majority of the property’s income, you have to remember you’re dealing with humans who can cause headaches.

It doesn’t matter if these tenants have been great and signed long-term leases, sometimes they’ll leave unexpectedly.

Don’t forget those that will fail to pay rent on time or worse, those that will damage the property.

Con #4. Poor liquidity

If you’re going to be needing the money you plan on investing in an apartment building anytime soon, then you may want to rethink that option.

Investing in real estate is much less liquid than other investments such as stocks or mutual funds.

If you need cash quickly, it’s much easier to sell a few shares of stocks than it is your real estate investment.

Con #5. Liability

Although owners of apartment buildings will have insurance policies in place, they could still potentially be held liable for accidents and crimes that occur on the property.

You won’t encounter this type of risk when investing in other assets such as mutual funds, bonds or REITs (real estate investment trust).

Real Estate Syndication vs REIT

Summary

Owning an apartment building comes with both pros and cons.

Even though earning passive income is one of the best reasons to own real estate, it’s the tax benefits and depreciation which put the icing on the cake for owners.

Also, don’t forget about how owning an apartment vs a single family home can increase the economies of scale.

While there are downsides to apartment building ownership, they can often be easily mitigated by being proactive in the marketplace and getting to know the sponsor in the deal.

Join the Passive Investors Circle