One of my first real estate mentors was Joe Fairless. Early on in my journey, he was nice enough to host me on his podcast (I guess to show that literally anybody can invest in real estate, even a periodontist 🙂 )

Joe helped me get started investing passively in real estate by teaching me some of the common terminology. Similar to dental school where I had to learn what a MOD amalgam was, Joe thought it was important to learn terms such as: cap rate calculation, internal rate of return (IRR), equity multiple and cash on cash return.

I quickly realized that if I wanted to become a real estate investor, I’d have to become familiar with a variety of important metrics to analyze the potential profitability of a rental property.

And one of those is the cash on cash return calculation.

In this article, we’ll define what a cash on cash return is, we’ll take a look at the cash on cash return formula, and finally we’ll use an example to help you quickly understand how to use it during your real estate investing journey.

Don’t Miss Any Updates. Each week I’ll send you advice on how to reach financial independence with passive income from real estate.

Sign up for my newsletterWhat Is a Cash on Cash Return?

Cash-on-cash return (CoC) is an annual measure of an investor’s earnings on a property compared to the amount they initially spent to purchase it and make it operational. In other words, it’s the return on the capital invested into a rental property.

It’s comparing the cash put in vs the cash coming out. This is especially useful for real estate investors trying to get an accurate picture of the amount of cash flow.

We want to know for every dollar we put into an investment, what do we get out in return?

To sum it up: it’s the relationship between a property’s actual cash flow and the initial equity investment.

How To Calculate Cash on Cash Return

In order to calculate the annual pre-tax cash flow on an investment property, you’ll first add up the annual gross rent intake as well as any other income received from the property.

This could include:

- laundry

- covered parking

- storage units

This calculation will give you the gross income.

Next, subtract operating expenses and annual debt service to obtain the net operating income (NOI).

Examples of operating expenses are:

- maintenance

- property manager

The next step is to divide the NOI by the amount of money invested into the property. The resulting percentage is the cash on cash return.

Cash on Cash Return Formula

The formula for calculating a cash on cash return is as follows:

CoC Return = Net Operating Income (NOI) / Total Amount of Cash Invested

The CoC return is typically expressed as a percentage.

Let’s use an apartment syndication as an example. This is where you have a sponsor (general partner) and limited partners (passive investors) that come together to purchase a real estate asset.

In this situation, the sponsor finds and purchases an apartment complex for $10 million. The sponsor and limited partners fund $2.5 million in the deal and then the remaining $7.5 million is financed.

Aside from the down payment, $200,000 was paid in various closing costs and fees bringing the total invested to $2.7 million.

After the first year of operations, the annual rental revenue from the property is $1.1 million. Regarding the expenses, the mortgage payments totaled $550,000 plus $200,000 was spent on other operating expenses and improvements.

Remember, to determine the cash on cash return, you must first calculate the annual cash flow from the investment. The annual cash flow from the first year is:

- Annual net cash flow = total gross revenue – total expenses

- Annual net cash flow = $1.1 million – $750,000

- Annual net cash flow = $350,000

Now, we divide the annual net cash flow by equity invested to determine the cash on cash return.

- $350,000 / $2,700,000 = 12.9%

The property’s total return (CoC) is 12.9%. This tells us that the property’s annual profit will be 12.9% of the cash initially invested.

Two Cash on Cash Return Versions

Regarding apartment syndication investing, occasionally you’ll see two different versions of the CoC return:

#1. Includes profits from the sale of the apartment

This will show the passive investors how much money they should expect to make long term from the project as a whole.

#2. Excludes the profits from the sale of the complex

This will show the passive investors how much money they should to expect to receive for each distribution during the hold period, as well as an average annual return on their investment.

In order to calculate both CoC factors, you need:

- initial amount of equity investment

- projected annual cash flow

- projected profit from sale for both the overall project and to the passive investors

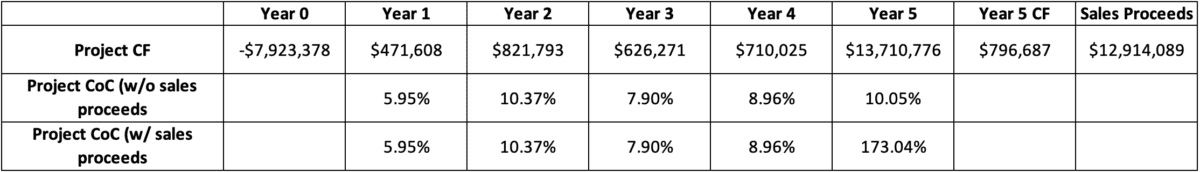

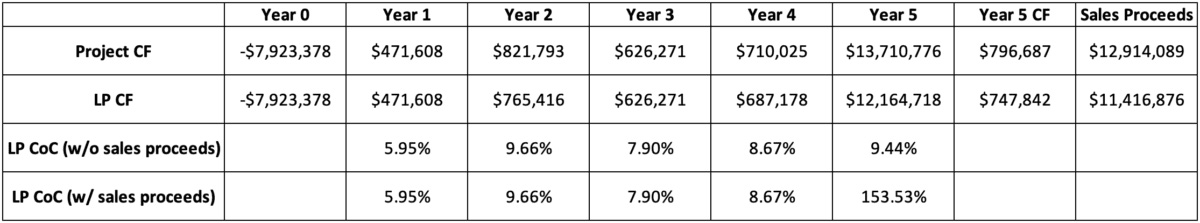

Here is an example from Joe Fairless of how to calculate CoC return for an apartment project (note: CF = cash flow)

Here is an example of how to calculate the CoC returns to the limited partners based on an 8% preferred return and 70/30 profit split after the sale:

In this example, the average annual CoC to the limited partners is 8.33%.

Here’s the calculation:

5.95% + 9.66% + 7.90% + 8.67% + 9.44%/5 = 8.33% annual return

This turns out to be above the 8% preferred return originally offered.

The overall CoC for the five years is 185.72%.

In this case, if you’d have invested $100,000, you would have made $85,720 in profit.

3 More Cash on Cash Return Examples

Here’s three more examples of how cash-on-cash returns are calculated in different real estate investment scenarios:

Example #1

Dr. A decides to get into the real estate investing game as he’s tired of his patients telling him that they “hate going to the dentist.” 🙁

He finds a nicely kept single family home and writes a check for it in the amount of $250,000. It has a history of $20,000 annual cash flow which gives him: $20,000 / $250,000 = 8% cash-on-cash return.

Example #2

Dr. R also finds a single family home in which purchases for $250,000 all cash. But unlike Dr. A’s house, it’s needs some TLC. Dr. R has to come out of pocket $50,000 for the repairs and it has an annual cash flow of $25,000: $25,000 / $300,000 = 8.3% cash-on-cash return.

Example #3

Dr. N is only two years out of his radiology residency and also wants to join his partner, Dr. R, in real estate investing.

He’s not able to stroke a check for the full amount so decides to use leverage instead.

Related article: How To Use Debt To Build Wealth

He’s able to put $50,000 down on a duplex with a $10,000 annual cash flow after debt service: $10,000 / $50,000 = 20% cash-on-cash return.

3 Benefits Of a Cash on Cash Return

Here are three reasons why investors utilize a property’s cash on cash returns:

#1. Property selection

One of the most practical uses of the CoC return has to do with selection of a property. Using the calculation allows you to perform a fast, side-by-side analysis of multiple deals based on the information available such as:

- operating expenses

- rent roll

- other seller provided financials

#2. Financing costs

Another benefit to investors using a CoC return is that it factors in the cost of financing.

This helps them determine what terms they’d need in order to achieve a certain CoC return.

Typically the CoC return is lower (assuming revenues and cost remain constant) when an investor has more equity in a deal (as a percentage of the loan-to-value) versus less equity in the deal.

Also, the cost of financing can impact the CoC return as well.

#3. Insights to a property’s expense profile

Cash on cash returns provide useful insights as to a property’s expense profile.

Those with higher expenses will result in lower cash on cash returns. By knowing the expenses, a prospective buyer could determine if there are possible cost savings that can be implemented to increase the return.

How Is The CoC Return Different From Other Metrics?

Now that you’re familiar with what a CoC return is and how to calculate it using different examples, let’s take a look at four other common financial metrics used to evaluate a property’s performance:

#1. Net operating income (NOI)

The NOI is calculated by subtracting the property’s operating expenses from the income it’s generated. Some of these expenses are: maintenance, utilities, landscaping and allowance from vacancies.

When performing this calculation, the debt service is NOT included where as the CoC return DOES include it.

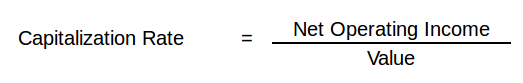

#2. Cap Rate

Cap rate, also known as capitalization rate, is used to indicate the rate of return expected for a particular property. It’s based on a ratio of the current income to the market value of the property and expressed as a percentage.

Investors use this financial metric to compare properties and estimate their potential ROI for a particular asset.

Typically the higher the cap rate, the higher the projected profitability.

Cap rates are calculated by taking the net operating income and dividing it by the market value.

Cap rate formula:

If the net operating income (NOI) isn’t provided, it can be calculated by taking the income received after expenses have been paid but before principal and interest payments, capital expenditures, depreciation and amortization.

Cap rate example

Dr. T is starting to feels signs of “burnout” and decides to do something about it. He wants to reduce his time in the clinic down to 2.5 days/week and focus on building additional income streams with real estate.

His friend is a local realtor and found him an apartment building with the following stats:

- Property value = $1 million

- Rental income = $100,000

- Operating expenses = $40,000

- Net operating income (NOI) = $60,000 (Income – expenses) ($100,000 – $40,000)

After reading this article, Dr. T is able to calculate the cap rate:

$60,000/ $1,000,000 = 6% cap rate

In this example, he can expect to receive an annual return of 6% from a rental property worth $1,000,000.

Here’s a quick video I put together further explaining cap rates:

#3. Internal rate of return (IRR)

The internal rate of return (IRR) is an estimate of the value it generates during the time frame in which you own it. The IRR is the percentage of interest you earn on each dollar you have invested in a property over the entire holding period.

When it comes to investing in real estate, time is money. So the longer an investor’s money is tied up the lower the IRR will be and the worse the investment will perform.

The primary difference between cash on cash returns and IRR is that IRR is based on total income earned throughout the ownership cycle whereas on annual segments with cash on cash returns.

The IRR formula is complex to perform. Most use a financial calculator, Excel spreadsheet, or specialized calculator via Google search.

#4. Return on investment (ROI)

Return on investment (ROI) measures the profit made (or could make if you plan to sell) on a property.

It’s calculated by comparing the amount invested in the property, including the initial purchase price plus any further costs, to its current value.

ROI formula:

Current market value – Cost of investment / Cost of investment

If you paid $500,000 for an office building last year and incurred no capital expenses and found out that it’s currently worth $600,000, the ROI would be:

($600,000 – $500,000) = $100,000) / $500,000 = 20%

What Is a Good Cash on Cash Rate Return?

As you can imagine, most investors want to know what constitutes a good return.

Unfortunately, there’s no specific rule of thumb regarding what constitutes a “good” one as it all comes down to the individual investing in a potential deal.

A good one depends on several factors, including an investor’s preferences and goals.

For example, if you’re a risk adverse investor like me, you may want to invest more equity into deals thus lowering the amount of leverage needed. Remember, the more equity, the lower the leverage and cost of financing, thus the lower return (CoC).

Some seasoned investors feel that a projected CoC of 8-12% is good while others think that 5-7% is acceptable depending on the market.

Some people are nearer to retirement and want less risk while others want to take on more risk as they still have several years (or decades) of work ahead of them.

Again, it’s all about meeting their investment objectives.

If you only want deals over 10% then go for it. If you want 6%, then only focus on those. You have do it what’s right for you because only YOU know what your risk tolerance and investing goals are important to you.

You want to be able to sleep better knowing that you’re doing what’s right for you and your family.

Bottom Line

As we’ve discussed today, the cash on cash return is a metric that can be used to guide investors to which investment will be more or less profitable when compared to others.

My goal is to educate you about the in’s and out’s of real estate investing (mainly passive).

Why?

Who has time (or wants) to deal with tenants?

As I continue learning myself, I plan on passing along my wins (and losses) to you so you can make an educated decision what’s best for your investment goals.

The first step in the vetting process starts with the numbers and the cash on cash return is an easy metric to start with.

Join the Passive Investors Circle