506b vs 506c

When I first started investing in a real estate syndication, one of the terms that I kept hearing about was Rule 506 of Regulation D.

My first thought was, “What you talkin ’bout Willis?”

As a periodontist with no background in investing in real estate, I had to spend months on self-educating myself in order to figure out what some of this new terminology meant.

Some of the terms I had to become familiar with included:

- Cap Rate

- Cost Seg

- Cash on Cash Return

- Triple Net Lease

- Private placements

- 1031 Exchange

- REITs

In 2012, President Obama passed the Jumpstart Our Business Startups Act (JOBS Act) that allowed businesses to advertise and sell securities, so long as they were made only to accredited investors that are verified using “reasonable steps.”

Do you know what is meant by the term accredited investor status?

The definition of an accredited investor per SEC guidelines is:

- A natural person with an annual income of at least $200,000 in each of the two most recent years or $300,000 for a married couple. There must be a reasonable expectation of the same high income level in the current year; or

- A natural person or married couple with a high net worth of at least $1 million which does NOT include a primary residence.

Research shows that 8.25% of all American households – or roughly 10,000,000 households – count as Accredited Investors.

For more information, check out the article: “How To Become An Accredited Investor & Why It Matters“

For eight decades before the JOBS Act was passed, companies wishing to sell private securities had to rely on friends, family, or their own networks as securities laws didn’t allow for general solicitation.

The only way was via Rule 506 of Regulation D.

But in September 2013 things changed when Rule 506 was split into two sections:

506b and 506c

Regulation D Offering

Regulation D (Reg D) includes two important exceptions to the general requirement securities registration with the Securities and Exchange Commission (SEC) set forth in the Securities Act of 1933.

Through Reg D, syndicators can raise money or capital from investors without having to register the securities with the SEC if the following requirements are met:

- Must file a notice to the SEC on Form D within 15 days of the date of the first sale of a Reg D security on the SEC’s Edgar System (online database that allows for electronic filing) – Form D asks for basic information about the offering and the issuer

- Must file a notice with the state in which the security is sold within 15 days of the first sale – the majority of states have an online database to allow for electronic filing through the North American Securities Administrators Association (NASAA).

The two distinct Reg D registration exceptions are 506b and 506c.

506b vs 506c

Here’s a quick video overview from Verify Investor of the differences between 506b vs 506c:

What is Rule 506b?

The “old” or original rule was known as Rule 506, but is now known as Rule 506(b).

It allows companies to raise an unlimited amount of money from an unlimited number of Accredited Investors and up to 35 Sophisticated Investors.

A Sophisticated Investor is one who has such knowledge and experience in financial and business matters that he or she can evaluate the merits and risks of the prospective investment. Many times this is someone that has started their own business before.

Many dentists and physicians fit into this category.

One of the first questions I get from the new members that join our Passive Investors Circle has to do with being an accredited investor.

Usually they ask about the verification requirement or verification process that they must go through in order to be labelled an accredited investor.

Most don’t realize they’re able to self-certify by attesting they meet the definitions of an accredited investor per SEC rules.

Companies that sell securities can’t use any means of general advertising or solicitation to promote their offering.

To prove this, they must be able to demonstrate that they have a substantial prior relationship with you before they make any investment offerings.

Join the Passive Investors CircleGeneral guidelines – sales of securities

If an individual or company sells securities under the 506(b) exception, the general guidelines include:

- General solicitation or advertising of the securities offerings is prohibited

- Allowed to sell to an unlimited number of accredited investors (current accredited investor requirements are a $200,000 annual income individually ($300,000 jointly) or a $1 million net worth (individually or jointly) and up to 35 unaccredited investors (must be “sophisticated”)

- Must provide the non-accredited investors with disclosure documents, including an audit of the fund’s balance sheet

- Issuer may rely on investor self-certification

- Issuer must have a pre-existing, substantive relationship with potential investors

What is 506c?

In 2013, the second exception of the Regulation D rule was introduced – 506(c).

Under the new rule, those selling securities can advertise to anyone as long as they accept accredited investors only in their offerings.

They can advertise on their own websites (such as Grant Cardone’s Cardone Capital), as well as website platforms operated by others who generally pre-screen the viewers to restrict viewing of offering materials to Accredited Investors only.

However, in order to use this rule exemption, the issuer must be able to demonstrate that it took “reasonable and additional steps” to ensure the accredited investors status of all investors at the time of the investment.

In other words, the issuer must verify that the investors are accredited.

To do so, you can have your CPA, attorney, or a registered broker-dealer review the investors financials, such as W-2s, tax returns, brokerage statements, and credit reports.

Unlike 506b, self-certification is not permissible.

The main differences between the 506(b) and 506(c) are:

- Solicitation is prohibited for 506(b) but permitted for 506(c)

- Non-accredited investors may invest in 506(b) but not 506(c)

- Self-certification of investor status is permitted for 506(b) but not 506(c)

- You must have a substantive, pre-existing relationship for 506(b) but not 506(c)

Comparison – Summary

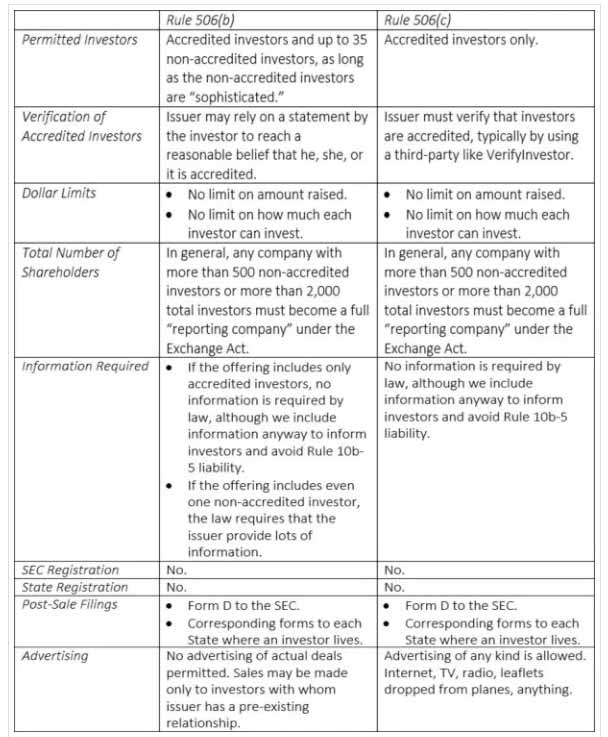

Here’s a chart comparing 506b vs 506c from Crowdfundingattorney.com:

There you have it. Now you know the difference between the 506b vs 506c.

Are you ready to start down the road of passive real estate investing?

If so, consider joining the Free Passive Investors Circle.

Join the Passive Investors Circle