8 Pros and Cons of REITs Are you looking for a way to add a passive income stream or as Grant Cardone calls it, another “flow” to your portfolio? If so, then one of the best ways is by using real estate. But the thought of owning a second home or becoming a landlord, however, may sound like a major headache. What can we do to solve this problem?

The more I learn about real estate investments, the more I realize that it basically boils down to two major strategies – active vs passive investing.

Related article: Passive Investing vs Active Investing – Which Is Best?

Most of us are busy professionals and tend to focus on investments that don’t take up much of our time. Within the passive investing strategy, two of the more popular investment opportunities are with apartment building syndications and real estate investment trusts, or REITs.

As a side note, most syndications require you to be an accredited investor.

We’ve discussed real estate syndications in the past so today I want to focus on the 8 pros and cons of REITs to see if it might be a good fit within your portfolio.

What’s a REIT?

A REIT, or real estate investment trust, is a company that owns, operates or finances income-producing real estate. They can either be private REITs or public REITs but for today’s discussion, we’re going to focus on the publicly traded REITs.

An example of a REIT is one that buys and manages property such as:

- office buildings

- shopping malls

- hotels

- health care facilities

- self-storage

- retail centers

- commercial properties

- apartment complexes

According to Investopedia, Congress established real estate investment trusts (REITs) in 1960 as an amendment to the Cigar Excise Tax Extension of 1960. The provision allows individual investors to buy shares in commercial real estate portfolios that receive income from a variety of properties.

Investors can purchase these shares through the purchase of individual company stock, mutual fund or exchange traded fund (ETF).

This makes for a relatively simple way for investors to add real estate assets to their portfolio.

In exchange for receiving favorable tax treatment (they can avoid corporate taxation), REITs must distribute 90% of their profits in the form of dividends.

Most REITs distribute these profits to their investors quarterly, which makes them a convenient interest-earning vehicle for retirees who want a steady stream of income.

There are 3 main categories that all REITs fall into:

1 Equity REITs

Equity REITs are the most popular that focus on acquiring, managing, and developing investment properties. Their main source of revenue is rental income from their holdings.

Examples include:

2 Mortgage REITs

Mortgage REITs don’t own properties directly. Instead, they wither buy existing mortgage loans or lend money to real estate investors. They mainly earn revenue from interest on the loans they hold.

3 Hybrid REITs

A combination of both mortgage and equity REITs, these REITs diversify by issuing loans to real estate investors and owning properties. Thus, they generate revenue from both rents and loan interest.

REIT Example

My personal experience with REIT investing is with the Vanguard Real Estate Index Fund (VGSLX).

According to the Vanguard site: This fund invests in real estate investment trusts—companies that purchase office buildings, hotels, and other real estate property. REITs have often performed differently than stocks and bonds, so this fund may offer some diversification to a portfolio already made up of stocks and bonds. The fund may distribute dividend income higher than other funds, but it is not without risk.

Here’s a breakdown of the Portfolio Composition:

As you can see below, it invests in a wide variety of different types of REITs which as of this writing includes assets over $64 Billion dollars.

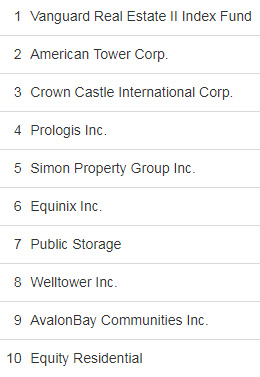

10 Largest Holdings

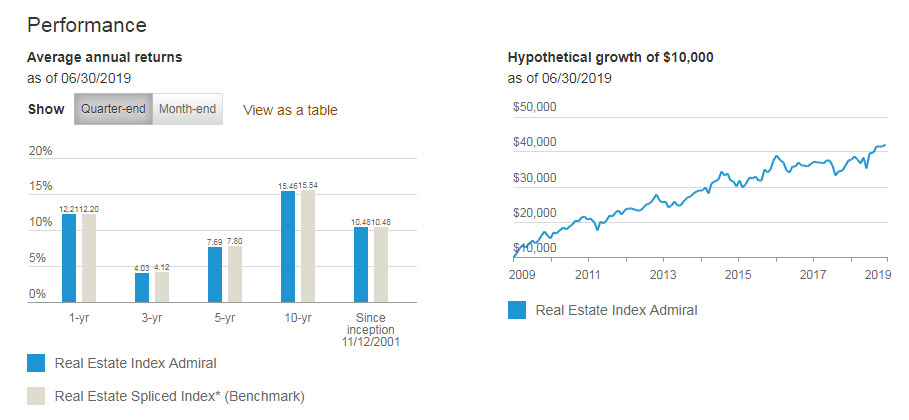

Its performance has been very impressive with earnings just over 10% since it’s inception in 2001:

8 Pros and Cons Of REITs

As with most investments, REITs have their advantages and disadvantages. Simply put, this may or may NOT be the right investment for everyone.

As with anything else, make sure you do your part to educate yourself before making any investment decisions.

Here are the 8 pros and cons of REITs:

REIT Pros

1) Buying and selling is easy

Because most REITs trade on public exchanges, they’re very easy to buy and sell. They are about as easy as buying and selling stocks.

2) Highly liquid

One of the reasons investors shy away from real estate is that it’s known as being notoriously illiquid. Occasionally, property can take a long time to sell or purchase.

Investing in REITs is way to eliminate the illiquidity risk as shares are bought and sold on major U.S. stock exchanges every day.

3) Lower cash flow risk

REITs offer attractive risk-adjusted returns and stable cash flow as they are highly diversified with 1000’s of properties to choose from.

4) Higher diversification

Several years ago, our investment portfolio was 98% in the stock market. I wanted to make a change and diversify some portion of it and did so with the Vanguard Real Estate Index fund discussed earlier.

For the most part, a real estate presence can be good for diversifying a portfolio by offering a different asset class that can act as a counterweight to equities or bonds.

REIT Cons

1) Taxation

Unfortunately for those that invest in the best REITs for income; they’ll have larger tax consequences to deal with. Why? The federal government taxes dividends at a lower rate than ordinary income but that dividend tax benefit doesn’t apply to REIT holdings.

Because of this, most advisors recommend holding REITs within tax-deferred accounts (401(k), IRAs, etc.) due to the fact that REIT dividends are considered ordinary income on tax returns.

2) May rely on debt

Occasionally, a higher dividend payout by many REITs may force their management to go for higher leverage to expand the real estate holdings. This would result in higher interest going out and also would reduce their earnings.

3) Property taxes

State and municipal authorities have the right to increase property taxes to increase their budget revenue. This would reduce the REITs’ earnings within those states.

4) Tax inefficient

When comparing REITs to rental properties, actively managed real estate is more tax efficient. Starting on the first year, they can take depreciation which can lower their “income” with a non-cash expense.

Also, other property-related expenses can be deducted including interest earned from the income.

REIT Investing Takeaway

Now you know some of the pros and cons of REITs and if they are possibly a good fit within your investment portfolio.

How do you invest in REITs?

Remember that one of the advantages of REITs was the ease of both buying and selling. You can buy REITs through most brokers as over 200 REITs are publicly traded on stock exchanges. This includes REIT mutual funds and REIT exchange-traded funds (ETFs).

Don’t Miss Any Updates. Each week I’ll send you advice on how to reach financial independence with passive income from real estate.

Sign up for my newsletter