[Editor’s Note: Today’s article in a guest post from Landon Murie, CEO of Goodjuju. His company helps property managers market their services.]

There are hundreds of thousands of comfortably retired millionaires who got that way through rental property investing.

Here are 10 ways that rental property investments create wealth, and why we’d encourage doctors to take a serious look at them to begin building their wealth.

10 Ways To Become a Real Estate Millionaire

#1 Income Tax Advantages

As an investment, rental property owners can deduct all valid expenses, including:

- mortgage interest

- property taxes

- insurance

- advertising

- property management fees

- utilities

- depreciation

The last item, depreciation, is one of the main benefits of becoming a real estate investor.

The IRS allows the value of a structure to be depreciated over 27.5 years for residential investment property.

For example, a structure that costs $250,000 would result in an annual deduction of $9,091.

That is $757/month, enough to offset all the profit from the investment for taxes.

In many cases, the losses on a real estate investment can be used to offset gains on other investments.

These are wealth-building tools of the rich.

#2 Monthly Cash Flow

There are two important areas of due diligence that investors use to determine the best rental property investments.

First, they must determine their costs for acquiring the property.

After that comes other expenses such as:

- taxes

- insurance

- utilities

- marketing

- repairs

- maintenance

If you’re going to hire a property manager to take care of the vacancies and hassles, the monthly fees for that usually range from 6-12% of the monthly rent rate and need to be factored in too.

The investor must know their costs with the mortgage as a monthly expense figure.

This is the only way they can go to the next due diligence item, the rent they can charge. The investor must study the local rental market, the competition, and determine what can be charged for rent.

Once the costs and the projected rents are known, if the rent is larger than the costs on a monthly basis, then there will be a positive monthly cash flow.

How much in monthly cash the investor wants is up to them.

#3 Appreciation in Value Over Time

Historically, real estate has grown in value even though there are ups and downs in the market.

However, over enough time, homes should be worth more than when they were purchased. Even in today’s slower appreciation situation, 3%/year in value appreciation can be expected for most markets.

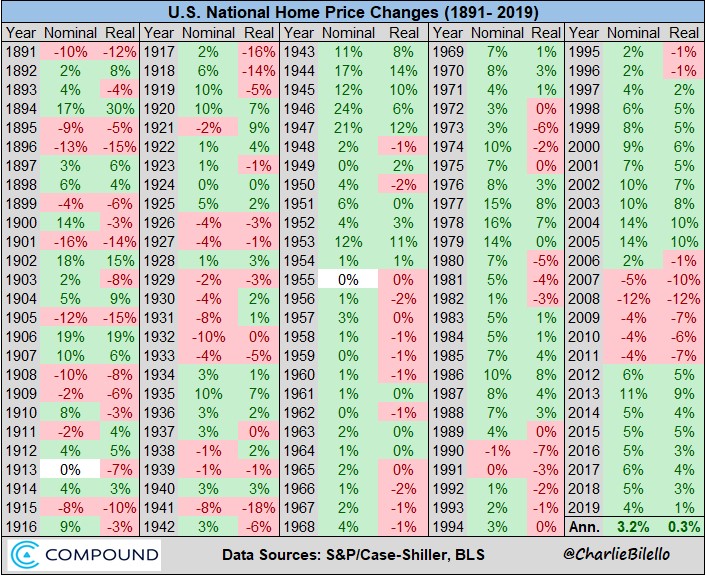

According to Compoundadvisors.com, since 1891, U.S. home prices have increased 3.2% per year before inflation (nominal) and 0.3% after inflation (real).

#4 The 1031 Tax Deferred Exchange

Investors who dedicate many years to building a portfolio of rental properties enjoy another lucrative tax advantage called the 1031 tax deferred exchange. This allows them to sell one property at a profit and reinvest the returns into another property while deferring capital gains taxes.

If a doctor investor has several lower priced properties that have been profitable, but they want to grow their portfolio value with higher value homes at higher rents, they can sell off properties and use the proceeds to buy others that make better investments.

This deferral of capital gains allows them to maximize their reinvestment and grow their portfolios and profits consistently over time.

The 1031 Exchange defers the capital gains taxes until the investments are finally liquidated. However, there really is a way to “take it with you,” or sort of.

If you build a large portfolio over time using the 1031 Exchange, when you die your portfolio goes to your heirs and they inherit at the “stepped-up” value of the property. This means the value at the time of your death.

So, the capital gains taxes deferred over time on the growth just go away with inheritance.

Real estate has created many millionaires and it’s certainly worth a look for those who want to retire in comfort without fear of outliving their income stream.

#5 Freedom and Time

As a busy doctor, you’ve got a lot of other things you probably want to be doing with your time,.

One of the best reasons to invest in rental properties is they’re constantly bringing in money without you having to lift a finger aka passive income.

Let me ask you something.

Do you…

- Want to spend time expanding your business/practice?

- Want to start another side business or venture?

- Want to buy even more property or investments?

As long as you have a property manager who is effective, proactive, and competent (as outlined here), you’re pretty much as hands-off as you would like to be.

You’re free to focus on other investment activities while your rentals do their thing, cranking out rent payments month-in and month-out.

Don’t Miss Any Updates. Each week I’ll send you advice on how to reach financial independence with passive income from real estate.

Sign up for my newsletter#6 You Can Sell at Anytime and Take the Cash

Real estate is a long-term investment – but it doesn’t have to be if you don’t want to. The great thing about rental properties isn’t the monthly revenue alone; it’s the fact that you can cash out at any moment, no questions asked.

Think about it:

- Investing in stocks might be a decent option – but when it’s time to cash out, you’ll have to time the market which is never too stable (or you will lose money).

- You can also invest in paintings, cars, and memorabilia – but good luck finding a buyer fast enough.

Good old brick and mortar is still the best option for people looking to invest in reliable assets.

Your investment is safe; you can sell any time you want to; and, if you decide to keep your rental property, you get a check every month. It doesn’t get any better than that.

#7 Lots of Leverage

Getting loans and borrowing money for real estate is much easier than other types of investment loans.

Let’s put it this way… If you walked into a bank and wanted to borrow 100k to invest in the stock market, good luck.

But If you stepped in that same bank and wanted to borrow 100k to invest in a rental property, you’ll probably be taken more seriously. This is because real estate holds it’s value and is less of a risky investment which makes it easier to borrow money for.

Now that’s some serious leverage.

#8 Tenants are Paying off The Mortgage

Have you ever heard of an investment that pays for itself?

How would that work?

It’s simple: you get a mortgage to buy a rental property.

Every month you pay back a small portion to the bank and at the same time, you get monthly rent from your tenants.

If your mortgage payments are significantly less than your tenants’ rent (as it should be), then you’re set.

Even if your rental property income isn’t significantly more than the mortgage payments, you’re still paying it down each month plus pocketing the cash or reinvesting it!

#9 People Always Need a Place to Live

Supply and demand (S&D) is simple and straight forward to understand.

- If there’s more supply than demand, prices go down.

- If there’s more demand than supply, prices go up.

That’s it.

Of course, the problem lies humans nature:

- For example, let’s say there’s a lot of demand for something today – but it plummets tomorrow because the trend died down (e.g., fidget spinners).

- Or, another example, Chinese factories close and supply disappears overnight (it happened during the worst part of the COVID pandemic).

Most goods and services work under that type of uncertainty. Rental properties don’t have that problem, though. Why? Because nobody is making more land – and the world’s population is ever-growing.

Simply put, when you buy a rental property, you get to own a product that everyone needs but not a lot of people have. You’ll be in business forever which is a GREAT problem to have.

#10 Rents are Steadily Climbing Over Time

When it comes to monthly rent, the sky is the limit. Sometimes rents can double every couple of years in some of the hot markets.

Why? You probably already know the answer.

A factory can’t create a piece of land; you can only buy what’s already here. And with every year that goes by, the world population increases.

The more people there are, the more people that need a place to live. With each passing year, the demand for rental properties goes up – and the supply remains steady.

Before you know it, you’ll be earning two or three times more than you did before in rent money!

And that’s a tried-and-tested way to build wealth.

Bottom Line

There are several ways you can choose to invest your money. For the reasons mentioned above, real estate is an amazing way to build real wealth and help doctors on the path to becoming millionaires quicker than solely relying on their active income.

Join the Passive Investors Circle