The HSA Triple Tax Advantage

For those that are striving towards FIRE (Financial Independence, Retire Early), one question that has to be addressed is: How to pay for healthcare?

Baby Boomers don’t have to worry too much (hopefully) with Medicare still in place. But what about the younger generation and FIRE members? I realize that they have decades to figure out how to pay healthcare expenses without spending their entire nest egg.

The good news is, there’s a way to BOTH save for healthcare expenses plus getting some cool tax breaks. This can accomplished with a Health Savings Account (HSA) which is also known as a Stealth IRA.

What Is An HSA?

Here’s how Dave Ramsey explains what a Health Savings Account is to a caller:

For the most part, people are familiar with tax-advantaged accounts such as:

- 401(k)

- 529 college plans

- IRAs

But one that’s not quite as well-known is the HSA even though it offers three separate tax benefits.

An HSA is a tax-advantaged savings accounts for medical expenses. In 2005, President Bush put this into place as part of a plan for reducing the nation’s spiraling health care costs. In fact, it’s one of the best things he did for America.

Who Can Get An HSA?

Those enrolled in a high-deductible health plan (HDHP) are eligible for an HSA.

According to HealthCare.gov, a HDHP is:

For 2019, the IRS defines a high deductible health plan as any plan with a deductible of at least $1,350 for an individual or $2,700 for a family. A HDHP’s total yearly out-of-pocket expenses (including deductibles, copayments, and coinsurance) can’t be more than $6,750 for an individual or $13,500 for a family.

For 2020, the IRS defines a high deductible health plan as any plan with a deductible of at least $1,400 for an individual or $2,800 for a family. A HDHP’s total yearly out-of-pocket expenses can’t be more than $6,900 for an individual or $13,800 for a family.

For those already enrolled in Medicare, contributing to an HSA isn’t an option. But you can contribute to one if you decline Medicare when you turn 65.

What Are The Contribution Limits?

Just like a 401(k) plan or IRA, there’s annual contribution limits for HSAs.

Here are the HSA Contribution Limits for 2019:

- For single-only coverage, the limit is $3,500.

- For a family, the limit is $7,000.

And here are the HSA Contribution Limits for 2020:

- For single-only coverage, the limit is $3,550.

- For a family, the limit is $7,100.

We funded an HSA for years using our HDHP but once our premiums tripled, it was time to look for other options.

Luckily we found out about Medishare and were able to drop our health insurance.

Medishare is a health care sharing program facilitated by Christian Care Ministry (CCM) through which a community of believers voluntarily come together to share the cost of one another’s medical bills.

What’s The Difference Between A Health Savings Account (HSA) And Flexible Spending Account (FSA)?

You’re able to pay for out-of-pocket health care expenses with pretax dollars using both HSAs and FSAs.

Money that is set aside in a FSA must be used within that calendar year or it’ll be lost. You either use it or lose it. Our practice usually gets several patients that call in December each year that want to schedule their surgery before they lose their FSA money.

In contrast, HSA assets roll over to the next year, earn interest and can be invested. You can even use HSA money tax-free even if you no longer have an HSA-eligible insurance plan. As long as you contributed the money while you were eligible, you can use an HSA at any point.

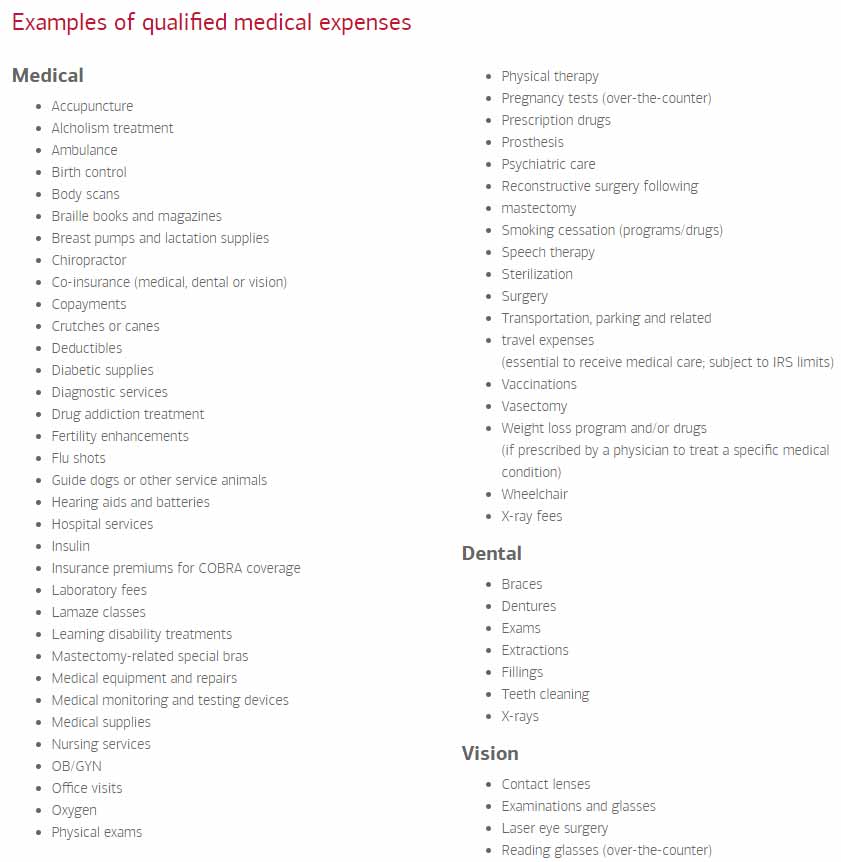

What Expenses Does An HSA Cover?

Here’s a list of some of the qualified expenses that an HSA covers from the Health Accounts Department of Bank of America:

Some of the treatments that are not covered include:

- medicines obtained from other countries

- cosmetic surgery

- health club memberships

- veterinary services

The HSA Triple Tax Advantage

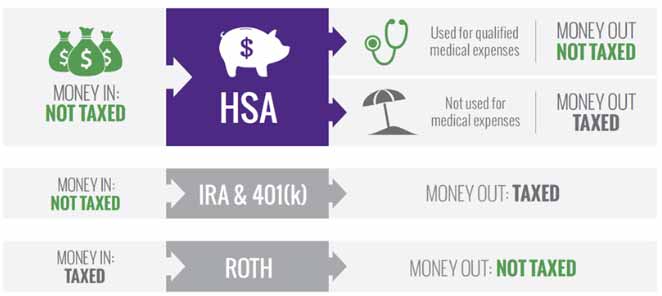

One of the most amazing benefits is that an HSA offers a triple tax advantage.

1. Tax-free contributions into an HSA

As a high-income earner, one of the first things you should do with the money coming in is to find ways to lower your tax bill. Typically we recommend starting with funding tax deductible retirement accounts such as a traditional 401(k) or IRA.

These deductions help reduce your overall taxable income which could push you into a lower tax bracket.

If you decide on funding an HSA, you’re allowed to write-off the money you contribute for the year and you have until the annual filing deadline to make contributions for the previous tax year.

2. Tax-free growth in an HSA

One of the mistakes I see people make is not taking advantage of the tax-free growth on earnings. For instance, I was recently helping a friend develop a financial plan for their family and he informed me that they had an HSA account. When I questioned him what types of investments their money was in, he informed me that it was in a money market account earning less than 1% annually.

Whenever you open an HSA account, pay particular attention to the different types of investments offered. If available, take advantage of low cost index funds or other low cost mutual funds. Picking the right mix of investments is key to maximizing your earnings.

There is also no expiration date on an HSA and no required minimum distribution (like from a 401(k) or IRA. This means that account holders can potentially spend years growing the funds in their HSA — all tax free.

3. Tax-free distributions from an HSA

The third advantage of an HSA is that distributions can be taken out tax-free. Typically money is taxed when taken out of tax advantaged accounts such as a 401(k) or an IRA due to the fact that contributions are tax deductible.

But that’s not the case with an HSA. As long as the funds are spent on qualified medical expenses, all withdrawals are not taxed.

Spending HSA funds on non-qualified medical expenses results in taxes and an additional 20% penalty.

How The Triple Tax Advantage Pays Off

Here’s a summary of how the HSA triple tax advantage pay off:

All in all, HSAs are great for saving on taxes because:

All in all, HSAs are great for saving on taxes because:

1) Money is NOT taxed when put into it

2) The interest earned is NOT taxed

3) Withdrawals are NOT taxed when used for qualified medical expenses.