I was at my son’s junior high football game recently talking to my friend Tommy. He told me that he’d overheard talk in the stands about a group that donated money to our local high school for the use of a new pavilion in the end zone.

He knew that I was part of this group but couldn’t figure out why my name wasn’t mentioned. I told him, “I’m glad people don’t know I’m involved. I like to fly under the radar and practice stealth wealth.” He got a kick out of that as he’d never heard of that phrase before.

Are you practicing stealth wealth? Let’s find out…

What is Stealth Wealth?

I was first introduced to the term “stealth wealth” from my good friend over at Physician on Fire. He dedicated a blog post about this topic. In all honesty, I’ve known and practiced it for years but didn’t have a specific name for it.

The book, The Millionaire Next Door, by Thomas Stanley and William Danko, sums up what it means to live in this manner.

Much like the stealth bomber, people living like this fly “under the radar.” They are not flashy. If you drove by their homes, you’d never guess a millionaire resides there.

I can’t tell you how many people, after they pull into our driveway, ask, “Why do you live here?” Why wouldn’t I? It’s paid for!!

Anyway, one of the authors of the Millionaire Next Door, Thomas J. Stanley, was obsessed with studying the wealthy.

The books states that after it’s all said and done, becoming a millionaire is not rocket science.

It’s simply a matter of:

- being a good planner

- living below your means

- avoiding a few stupid mistakes

7 Ways To Practice Stealth Wealth From The Millionaire Next Door

#1: Income does NOT equal wealth

Here is, in my opinion, the main reason docs aren’t as wealthy as they SHOULD be. They think that just because they have a great income, they can buy whatever they want whenever they want. Not for those of us that practice stealth wealth.

It doesn’t matter how much you make, it’s how much you SAVE. On average, millionaires invest at least 20% of their income.

Danko and Stanley offer a formula for determining whether you have a net worth that should be with your income:

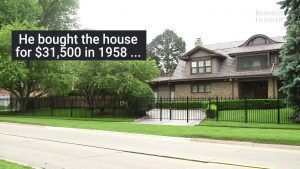

#2: Rethink your home situation

Let’s face it. Your home is your largest expense. Buying the “doctor house” too early in practice puts the shackles and chains on with little wiggle room for much else.

Not only will your choice of home matter with wealth accumulation, but also how often you choose one.

The books states that half of millionaires have lived in the same house for more than 20 years.

“Twenty years ago we began studying how people become wealthy. Initially, we did it just as you might imagine, by surveying people in so-called upscale neighborhoods across the country. In time, we discovered something odd. Many people who live in expensive homes and drive luxury cars do not actually have much wealth. Then, we discovered something even odder: Many people who have a great deal of wealth do not even live in upscale neighborhoods.”

– Thomas J. Stanley. “The Millionaire Next Door: The Surprising Secrets of America’s Wealthy”

Living in a modest neighborhood also has two other advantages:

- Less upkeep and expenses

- Lower property taxes

Many of my physician friends constantly complain about the amount of money they have to continue throwing at their houses.

Think about the difference in roofing, painting or flooring a 6,000 sq/ft house compared to a modest 2800 sq/ft home. I imagine it’s going to be 2-3x more. Don’t fall into this trap.

Another plus of living in a modest neighborhood is there is little to no competition. What I mean is that most keep to themselves and aren’t rushing down to the Mercedes dealership every time someone down the street leases a new one.

Do you remember what happened to Mike? Mike Tyson that is. At one time, Mr. Tyson was worth north of $400 million but eventually filed bankruptcy. Guess where a good chunk of his annual income went? You guess it, his mansion. A NY Times article stated that his house was costing him about $1.2 million of upkeep a year. Yikes! Maybe he should have moved in with Don King?

Here’s what one of the richest men in the world, Warren Buffett, has to say about all of this:

#3: They own & drive used cars

The number one goal for millionaires is to become financially independent. Having money doesn’t change their values and they don’t need to buy products to boost their status.

Because millionaires want to become financially independent:

- Only 23.5 percent of them own new or recent models

- 25 percent of them have not bought a car in 4 years

- Fifty percent never spend more than $29,000 their entire lives on vehicles

- About one in five never spend more than $19,000

- They realize a new car depreciates 19% as soon as you drive it off the lot

Most index funds average 7-9%. I don’t know about you, but I’d rather put my money in an investment vehicle that earns this type of interest instead of losing 19%.

(Remember to take into account that this book was published in 1996. But I can assure you that the above percentages haven’t changed much.)

What is the most popular car maker among millionaires, according to Dr. Stanley’s book, Stop Acting Rich?

Toyota.

#4: They don’t flaunt their income or net worth

I completed a one year general practice residency (GPR) at the Biloxi, MS VA hospital. Not being married at the time made many nights and weekends boring. For entertainment, my current wife and I would go to shows, concerts and eat at the local casinos. Our favorite was the Beau Rivage.

Typically the loudest tables were the winners which attracted a lot of attention. Usually when we made our way over to see what all the fuss was about, it was usually coming from a “high roller” with a girl on each arm and cigar hanging out of his mouth. They never had a problem constantly throwing money around and flaunting for all the spectators to see.

In order to practice stealth wealth, think about how you’d play poker. Ever heard the term “poker face”? During the game, you never divulge all the cards at hand. It doesn’t matter if you have a royal flush, only reveal two cards and keep them guessing! Why? This story I recently read from the Bible teaches us why.

In Isaiah 39:2-6 we learn about Hezekiah. He was so boastful of his riches that he told everyone about it. (Do you know anybody like that?) Not just how much his wealth is worth, but also where everything was stored. Here is the story:

“2 Hezekiah received the envoys gladly and showed them what was in his storehouses—the silver, the gold, the spices, the fine olive oil—his entire armory and everything found among his treasures. There was nothing in his palace or in all his kingdom that Hezekiah did not show them.

3 Then Isaiah the prophet went to King Hezekiah and asked, “What did those men say, and where did they come from?” “From a distant land,” Hezekiah replied. “They came to me from Babylon.” 4 The prophet asked, “What did they see in your palace?” “They saw everything in my palace,” Hezekiah said. “There is nothing among my treasures that I did not show them.”5 Then Isaiah said to Hezekiah, “Hear the word of the Lord Almighty: 6 The time will surely come when everything in your palace, and all that your predecessors have stored up until this day, will be carried off to Babylon. Nothing will be left, says the Lord.” -Isaiah (39:2-6).

Unfortunately, Hezekiah’s boastfulness cost him to lose it all, as he was robbed of everything.

Millionaires tend to never reveal everything that’s in their storehouse. They tend to be modest and less boastful and keep their salary and net worth to themselves.

Back to our poker game, by not revealing all your cards, you don’t think you’re better than others. By doing so, you don’t invite:

- envy

- jealousy

- other forms of negativity

#5: Time is $$$

Practicing stealth wealth also means spending some time behind closed doors setting up a budget and financial goals.

Most spend nearly 2x as many hours per month planning their investments than others.

Most of the millionaires in the book the following statements, while the majority of that were under accumulators of wealth (UAW) did not:

- I spend a lot of time planning my financial future.

- Usually, I have sufficient time to handle my investments properly.

- When it comes to the allocation of my time, I place the management of my assets before my other activities.

#6: They shop for bargains and never pay retail

One of the biggest turnoffs is when people boast about how much they pay for something. It’s as if they have to prove to the world that they have money, if though most don’t.

Those that understand stealth wealth despise advertising how much they paid for anything and the attention it attracts to their wealth.

MediaPost recently ran an article titled, “Millionaires Love Costco, Home Depot And Lowe’s”.

The article sited a survey from Millionaire Corner, an investment site owned by the Spectrem Group, based in Lake Forest, Ill., reports that among those with a net worth of $5 million or more:

- Home Depot is their favorite store, regularly visited by 57%

- Costco (46%)

- Lowe’s (44%)

- Target (41%)

- Walmart (33%)

Guess where they don’t shop:

- Lord & Taylor (2%)

- Neiman Marcus (8%)

Bottomline: Millionaires love to bargain shop.

The key takeaway here is, to hold and create wealth, become focused on saving money and when you do have to spend, bargain shop to get the most of your hard-earned money.

“I am not impressed with what people own. But I’m impressed with what they achieve. I’m proud to be a physician. Always strive to be the best in your field…. Don’t chase money. If you are the best in your field, money will find you.”

– Thomas J. Stanley, The Millionaire Next Door: The Surprising Secrets of Americas Wealthy

#7: Freedom is their aim

Millionaires aim for true freedom not luxury. As we’ve learned, they work hard and value true integrity. You’ll be hard pressed trying to find them posting on Facebook or Instagram about their private jet excursions or Nordstrom’s shopping sprees.

They practice stealth wealth. They shop at Home Depot, Target and Walmart. New cars on not on their radar. They look for deals whenever possible. They save and invest BEFORE spending.

The average millionaire doesn’t care what others think of them. They stealthily blend-in with the middle class.

Those that practice stealth wealth are givers. Donations are made whenever possible and they enjoy giving money to their church or organizations they believe in.

They know that money can’t buy happiness, yet this group are some of the happiest people out there. To them, money is a means to an end. Money is a tool.

They work hard to gain the freedom to not work for money. They let their money do the work for them.

Benefits to Stealth Wealth

I can’t tell you how many times I get asked, “Are you a coach?” As soon as I exit the practice each day, the scrubs are off and t-shirt and shorts are on. I’m usually headed to the gym or meeting friends on the tennis court (weather permitting).

Living the stealth wealth life allow you to be….you. I want people to like me for who I am, & NOT for what I do.

Wealth is not defined based on what ‘stuff’ you own. It is defined by the number of days that you don’t have to work to maintain your current lifestyle. It’s being financially independent.

You work because you CHOOSE to and NOT because you HAVE to.

If you want to be reminded of your wealth, let it be when you track your net worth. Free tools such as Personal Capital can help with this.

The biggest lesson we can all learn from the silent, and stealthy affluent, the real wealthy people in America is that it is more important to build wealth with the goal of freedom and humble consumption.

Practicing stealth wealth will allow you:

- Have greater control of your time

- Focus on the things you want

- Attending kid’s activities and school functions

- Ordering meals at a restaurant without worrying about price

If you want to stay wealthy, be stealthy.

Join the Passive Investors Circle