Do you want to lower your income tax bill? Who doesn’t?

But the more money you make, the higher taxes you have to pay, right? Well, maybe not.

Why do the ultra-wealthy like Donald Trump and Warren Buffett pay so little in taxes as compared to their income?

It’s because they know how to play the tax game.

Even if you’re in a high tax bracket, there’s multiple ways that you can use tax reduction strategies to pay the IRS as little as possible (legally of course).

But you have to make it a point to either stay on top of the ever changing tax laws or surround yourself with advisors that can do it for you.

I prefer the latter.

So, how can you take advantage of all these new tax laws and figure out what tax reduction strategies still exist for high-income earners?

Let’s find out.

Don’t Miss Any Updates. Each week I’ll send you advice on how to reach financial independence with passive income from real estate.

Sign up for my newsletterTax Basics 101

Before we get into the various tax reduction strategies for high income earners, it’s important that you understand the basics of taxes.

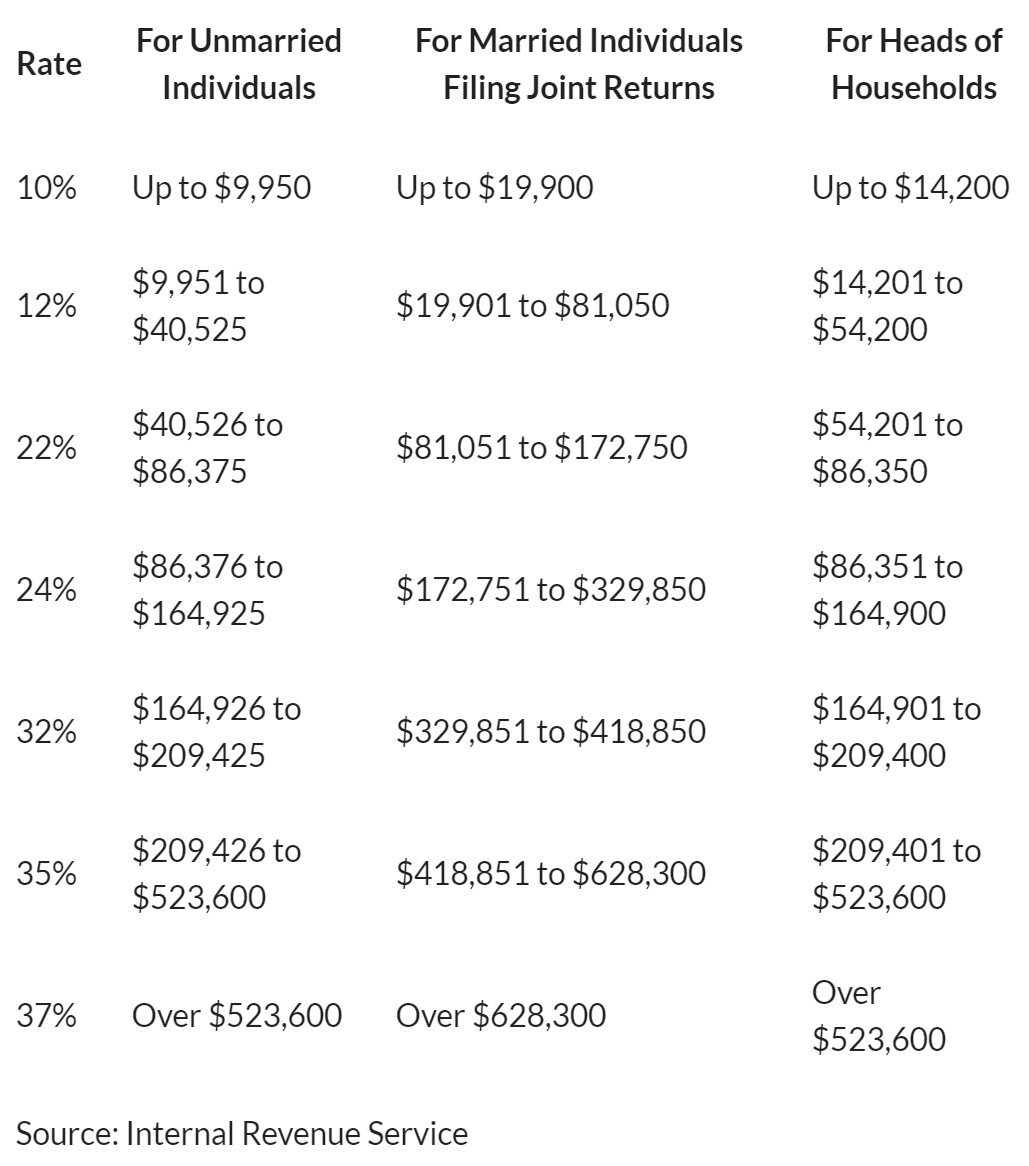

First, let’s start off with the federal income tax brackets.

2021 Federal Income Tax Brackets and Rates for Single Filers, Married Couples Filing Jointly, and Heads of Households

Your federal tax bracket is the percentage of tax that you owe the IRS on each tier of your taxable income.

Once you know your taxable income, you can use the chart above to determine your federal tax bracket.

High-income earners should always know how the next dollar of earned income will be taxed.

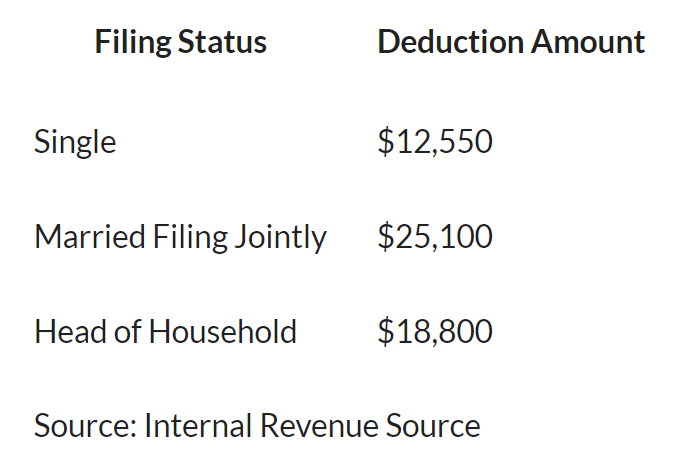

2021 Standard Deduction

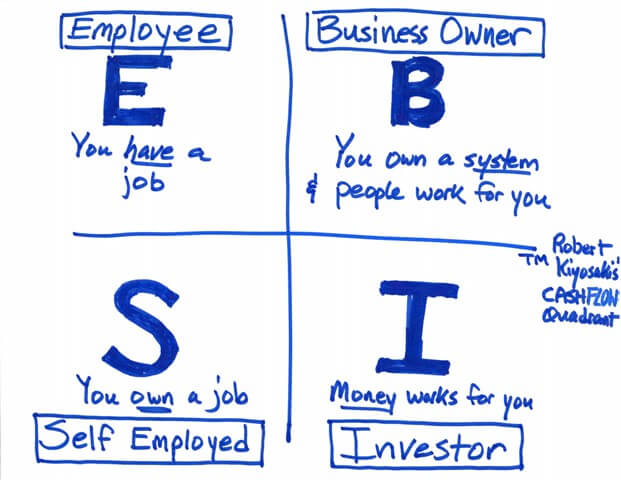

It’s for this reason that high income earners are always looking for new business opportunities.

Remember that business owners (and Investors) are on the right side of Robert Kiyosaki’s Cashflow Quadrant and pay the least amount of tax.

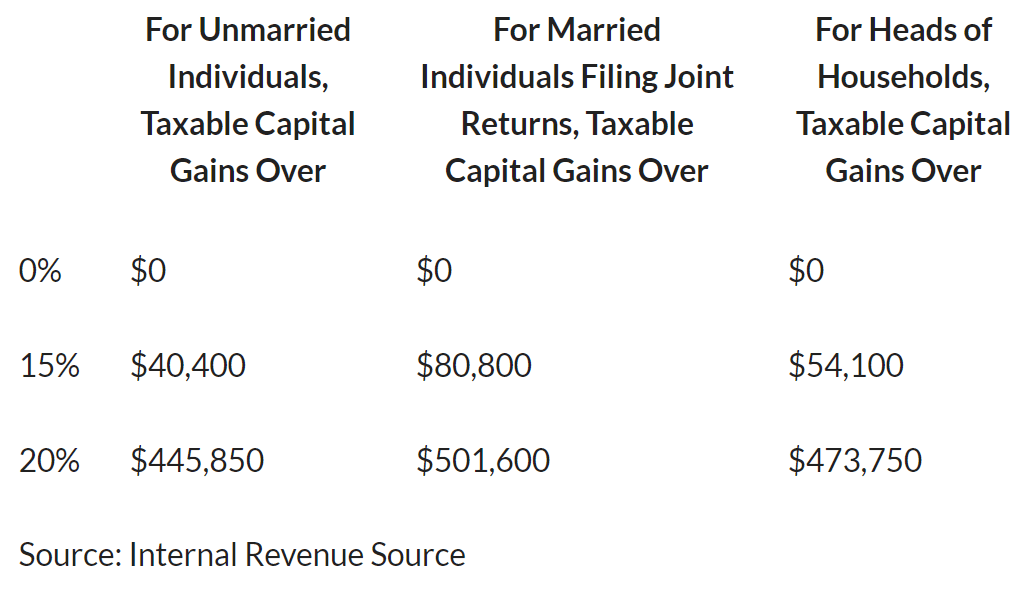

2021 Capital Gains Tax Rates & Brackets (Long-Term Capital Gains)

Typically long-term capital gains are taxed using different brackets and rates than ordinary income.

It’s important to know what those rates are.

The SECURE Act

The Setting Every Community Up for Retirement Enhancement (SECURE) Act which was part of the December 2019 tax package, includes several provisions that affect the high income earner’s retirement planning and tax planning strategies.

They include:

- The age for Required Minimum Distributions (RMDs) from retirement accounts was raised to 72 from 70.5, although if you turned 70-½ in 2019, you still need to start RMDs in 2020.

- There’s no longer an age limit for contributions to Traditional IRAs.

- Annual contribution limits were increased to $19,500 for 401(k)/403(b) plans and $13,500 for SIMPLE IRAs; Traditional and Roth IRA limits remain at $6,000. Catch-up contributions also increased to $6,500 for 401(k)/403(b) plans and $3,000 for SIMPLE IRAs, with Traditional and Roth IRA catch-up contributions staying at $1,000.

- Increasing the Social Security wage base by nearly $5,000 to $137,700.

- The income ceiling for Roth IRAs went up. Contributions now phase out at $124,000 and $139,000 of modified adjusted gross income. ($196,000 to $206,000 if you’re married filing jointly.)

- The limits on deducting long-term care premiums also increased to $5,430 per person for those ages 71 or over and $4,350 for those ages 61 to 70. Self-employed people can write off 100% of their premiums on Schedule 1 of the 1040.

These changes are significant because they make it possible for high income earners to make additional contributions to a retirement plan during the tax year.

Let’s get into some of the specific ways that high income earners can save on their tax bill.

5 Tax Strategies For High Income Earners

#1 Invest in retirement accounts

One of the easiest ways to begin slashing your annual income tax bill is by contributing to a retirement account. Investing in these types of accounts ( i.e. 401(k) and 403(b)) helps in that every dollar you put in is not taxed until you take it out.

These contributions allow you to reduce your annual tax burden. The reasoning behind this strategy is that if you wait until you have retired to withdraw money then your income will be lower as you’ll no longer be receiving a salary.

This results in putting you in a lower tax bracket. The money you withdraw will be taxed at a much lower rate than it would’ve been if you’d had to pay taxes when you earned it.

Contribution limits

Here’s a list of some of the contribution limits in 2021 compliments of Forbes.com:

401(k): The annual contribution limit for employees who participate in 401(k), 403(b), most 457 plans and the federal government’s Thrift Savings Plan is $19,500 for 2021—for the second year in a row. The catch-up contribution limit for employees age 50 or older in these plans is $6,500 for 2021.

SEP IRAs and Solo 401(k)s: For the self-employed and small business owners, the amount they can save in a SEP IRA or a solo 401(k) goes up from $57,000 in 2020 to $58,000 in 2021. That’s based on the amount they can contribute as an employer, as a percentage of their salary; the compensation limit used in the savings calculation also goes up from $285,000 in 2020 to $290,000 in 2021.

SIMPLE IRA: The contribution limit for SIMPLE retirement accounts is unchanged at $13,500 for 2021. The SIMPLE catch-up limit is still $3,000.

Defined Benefit Plans: The limitation on the annual benefit of a defined benefit plan is unchanged at $230,000 for 2021. These are powerful pension plans for high-earning self-employed individuals.

Individual Retirement Accounts: The limit on annual contributions to an Individual Retirement Account (pretax or Roth or a combination) remains at $6,000 for 2021. The catch-up contribution limit, which is not subject to inflation adjustments, remains at $1,000.

#2 Roth IRA Conversion

Converting your SEP, traditional or SIMPLE IRA to a Roth IRA can be a powerful strategy to help reduce the taxation of your future income.

Unlike a traditional retirement account, you don’t get a tax deduction when you fund a Roth but it does grow tax-free and any money you take out is 100% tax-free.

The IRS will allow you to take some of your existing IRAs or 401(k)s and convert them to a Roth IRA.

When conversions make sense

Before converting to a Roth, consult with your CPA or financial advisor.

Some of the best times to do a conversion are when you’ve had a year with less income than the previous year.

Another ideal time is when you’ve been temporarily placed in a lower tax bracket due to retirement and must take the required withdrawals.

Another thing to consider is that you’ll have to pay taxes on the conversion. This is when utilizing your CPA for advice to see if this strategy actually makes sense in your situation comes into play.

#3 Invest in real estate

One of my favorite tax strategies for high income earners is investing in real estate.

The main reason is that you’re able to recover the cost of income-producing property through the use of depreciation.

Depreciation example

The IRS allow owners of resident occupied real estate to depreciate property over 27.5 years.

An example would be of an apartment complex that was purchased for $3.5 million with a net operating income (NOI) of $200,000.

In this situation, the land, which is not depreciable, was valued at $750,000.

That leaves the remaining $2.75 million to be depreciated:

$2.75 million/ 27.5 years = $100,000

In this example, the IRS allows you to depreciate $100,000 a year over the next 27.5 years as a paper loss. ($2,750,000/27.5 yrs = $100,000)

Remember, the NOI was $200,000 but we’re NOT going to have to pay taxes on that amount because you’re allowed to subtract out that depreciation expense.

($200,000 – $100,000 = $100,000)

This means that you’re only going to be taxed on the $100,000.

Tax with depreciation

- $100K x 37% = $37,000

The depreciation represents a paper loss that can be taken against the actual gain from cash flow of the property which gets reported on a K-1.

If you have K-1 passive gains from other business activity then you can use those to offset actual gains which saves taxes in other areas of your portfolio.

Accelerated depreciation

The second strategy real estate investing can help high income earners save on taxes is by using accelerated depreciation via a cost segregation study.

This is where the IRS allows you to front load the depreciation instead of taking the standard 27.5 years.

Instead of taking the property and dividing into 2 components (building and land), you now divide it into 4 components:

- Land

- Building

- Personal Property

- Land Improvements

Personal property gets depreciated over 5 or 7 years. This is the non-permanently affixed items to the building such as: carpet, cabinets, drapes, etc.

Land improvements gets depreciated over 15 years. These improvements are: parking lots, curbs, swimming pool, sidewalks, etc.

1031 exchange

The third way real estate can help is via a 1031 exchange.

The term 1031 Exchange is defined under section 1031 of the IRS Code and is one of the most quoted tax benefits of real estate investing.

This strategy allows an investor to “defer” paying capital gains taxes on an investment property when it is sold, as long another “like-kind property” is purchased with the profit gained by the sale of the first property.

Here’s the rules of the 1031 exchange timeline (check with your tax advisor before performing).

- Timeline #1 – You have 45 days after you sell your property to identify up to 3 new properties. This can be done in writing but you have to purchase one or more of them.

- Timeline #2 – You have 180 days to close on one or more of the three properties that were identified.

The property that is going to be replacing the original property must be of equal or greater value.

Basically this strategy allows you a way to defer taxes by exchanging one property and replace it with a like-kind property. You’re able to take all of the proceeds from the sale of one property and buy another and the taxes on the transaction are deferred.

#4 Health Savings Account (HSA)

Health Savings Accounts (HSAs) are the only accounts that offer a triple-tax advantage.

What this means is that:

- Contributions are tax-deductible

- It grows tax-free

- Withdrawals are tax-free

HSAs are available only if you’re enrolled in a high-deductible health plan (HDHP).

HSA contribution limits for 2021 are:

- $3,600 for individuals

- $7,200 for families

- $1,000 55+ catch-up contributions

Other ways that you can benefit using HSA accounts:

- You can deduct your annual HSA contributions from your income taxes each year

- Once you reach age 65, you can withdraw funds from your HSA for any reason without penalty. If the money is used for nonmedical expenses, you’ll only have to pay regular income tax on the withdrawals.

#5 Set Up a Donor-Advised Fund

A donor-advised fund is a charitable fund that you can set up that allows you to decide how and when to allocate funds to charities.

Using a donor-advised fund (DAF) is probably one of the best tax strategies for high income earners.

Why?

Because it allows you to take current and future year contributions and deduct them all in the current year.

Here’s an example from my friend at Physician on Fire:

” You open an account at Vanguard (or wherever) and make a contribution. If you itemize, that contribution can be a tax deduction on this year’s taxes. Then the money stays in the DAF, invested in whatever you like for as long as you like. You pay the custodian a fee each year (the fee at Vanguard is 0.6%.) And then you “advise” the fund manager to donate money to your favored charities whenever you feel like doing so.”

This is a great strategy to implement especially if you have a year with higher-than-normal income due to an inheritance or windfall. It’s a good way to use charitable deductions to your advantage.

After you sign up with a custodian such as Vanguard or Fidelity, any money placed in the DAF becomes a charitable tax deduction.

This doesn’t mean that the money automatically goes to a charity. You’re the trustee of the account and get to decide what charities receive whatever amount you want in that year and in future years.

DAF Example

Let’s say that you plan on giving $20,000 a year to a local charity for the next 10 years. This would be $200,000 in donations. If this year you had a fantastic year at work and realize this extra income is going to put you in the top bracket (which you’re normally not in), then this might be the year to get that tax deduction.

If you fund the DAF with the $200,000, then you’ll be able to get a full tax deduction up front while you’re in the highest bracket.

DAF Stock Hack

Here’s another way to make using a DAF even more effective. Instead of donating cash, consider using any appreciated stock that’s held outside of your retirement accounts.

Whatever the stock is worth on the date of the donation into the DAF is now tax deductible. By doing this, you don’t have to pay tax on the gain on sale, making it a double benefit.

Conclusion

If you’re a high income earner wanting to try to save on taxes, don’t attempt to do it on your own. Wealth management is complicated.

It’s for this reason that it’s imperative to find the a reputable CPA that can assist you with tax reduction strategies to ensure that your money is working hard for you as efficiently as possible.

Are you interested in learning about #3 above, investing in real estate? Join the Passive Investors Circle today to learn more.

Join the Passive Investors Circle