Do you remember when you could order a burger and fries with no questions asked?

Unfortunately, those days are long gone.

If you tried that in restaurants today, you’d get bombarded with questions such as:

- what size burger – quarter pound? half pound?

- what type of bun?

- what would you like on it?

- sandwich only or combo?

- small, medium or large fries?

This is how I felt when I first started learning about real estate investing. Initially I thought you bought a house or duplex and rented it out.

Yes, you can do that, but there are several real estate asset classes you should be aware of before making an investment decision.

To keep it simple for you, real estate can be divided into two sectors:

- residential

- commercial

For our purposes today, we’re going to focus on the commercial sector as most syndications invest in this area.

Many doctors tell me that the reason they join the Passive Investors Circle is to learn more about and have access to physical assets that can provide them diversification in their portfolio along with cash flow. And commercial real estate is that area that can do that for them.

Of the multiple ways one can diversify their real estate holdings, two areas (asset class and property type) stand out. Understanding the differences between these two can be the key to success many high-income earners are looking for.

Here’s the basics on real estate asset classes versus property types and what you need to know.

Don’t Miss Any Updates. Each week I’ll send you advice on how to reach financial independence with passive income from real estate.

Sign up for my newsletterWhat Is An Asset Class?

According to Investopedia, an asset class is a grouping of investments that exhibit similar characteristics and are subject to the same laws and regulations.

Historically, the three main asset classes have been:

- equities (stocks, mutual funds)

- fixed income (bonds)

- cash equivalents (money market)

The 2020 pandemic caused many to rethink their long term investing strategies and look to other asset classes, such as real estate, due to changing market conditions. Myself included.

Before I started investing in real estate in 2016, our asset allocation was 98% in the stock market in the form of index funds. My goal now is to move towards a 50/50 split.

Most asset classes can be further broken down into other categories. Real estate, for example, has several different property types that it can be broken down into.

Real Estate Asset Classes

For our discussion, we’re going to use the terms “real estate asset classes” and “property types” interchangeably.

In real estate, there are 4 primary types of property which include:

- Residential properties

- Commercial property

- Industrial

- Land

Again, for our discussion today, we’re going to focus on the commercial real estate market as that is what most Passive Investors Circle members are interested in to create passive income.

5 Main Types of Commercial Real Estate

When you begin educating yourself about real estate, you’ll quickly realize there are a number of different types of commercial properties. This is no different than when trying to find a physician, there’s many different types from radiologist to gastroenterologist.

Here are the main types to consider:

#1 Multifamily Properties

A multifamily property is any residential property that contains more than one unit.

Examples include:

- duplexes

- townhomes

- apartment buildings

- condominiums

With regards to commercial real estate, multifamily is anything that is 5 units and above .

Typically the leases are short-term (1-3 years) which benefits the owners as rent can be adjusted to keep up with the market rate after the tenant’s lease expires.

Multifamily investments are attractive in markets that are growing thus causing a high demand with limited supply.

Many doctor investors with conservative investing goals (such as myself) like the multifamily space due to the potential lower risk factors.

Why you might ask?

The last time I checked, everyone needs a place to live.

#2 Office Properties

Office buildings offer a wide range of investing opportunities depending on the location.

Typically in city business districts (CBDs), they can range from large, multi-tenant structures to single-tenant buildings (such as a hospital’s medical offices).

Before the 2020 pandemic, investing in office space provided some of the most stable returns and predictable cash flows available among the real estate asset classes.

One of the reasons for this has to do with the underlying leases which are typically 5-10 years in length. This is due to being leased to businesses and not just individuals).

#3 Retail Properties

Retail space, similar to office buildings, have a wide range of options.

This includes small, local shopping centers (strip malls) that house single-tenant restaurants or grocery stores to large, regional malls.

These properties can be broadly affected by national employment growth and more locally via the location, population demographics, local area incomes and buying patterns.

Something that could potentially complicate this space is the fact there are a variety of lease terms which can impact its value.

For example, a retail building housing only one tenant with a lease expiring soon would be worth much less than the same building with a new 5-year lease.

Triple net leases (NNN leases) are popular in the retail sector.

Typically these leases are longer (10+ years) where the tenant pays all three expenses:

- taxes

- insurance

- maintenance costs

#4 Industrial

Industrial properties are designed and used for, you guessed it, industrial use.

Examples include:

- research and development (R&D) space

- manufacturing facilities

- distribution centers

- warehouses

Typically the research and development and manufacturing properties tend to be “build-to-suit” buildings that can be difficult to “re-tenant” without extensive modifications as they have been built according to the needs of the original tenant.

Big warehouses, in comparison, are used for distribution or manufacturing and are easier to adapt to.

On the other hand, distribution centers and warehouses are more generic buildings and can be easier to adapt to.

As a whole, this sector is influenced by large economic drivers such as imports and exports and less by local job growth.

Similar to office and retail centers, leases on industrial properties tend to be longer-termed. The downside is that many industrial buildings tend to be a higher risk as they’re occupied by a single tenant.

#5 Self storage

Roughly half of all the 23,000 self storage facilities have been built in the last 7 years.

Something else to consider is the large number of Baby Boomers that are set to retire, travel and downsize in the not too distant future. Some will also be purchasing second homes.

This is great news for the self storage owner/investor as the need for self storage for Boomers is going to skyrocket.

3 Classes of Real Estate

Similar to getting grades in schools, real estate is also graded with a class rating. Occasionally you’ll hear that someone is investing in a B or C class property.

This rating, which is on a scale from A to D, has to do with a combination of factors such as:

- age of the property

- location

- appreciation

- rental income

- amenities

For investors, property class is an important factor to consider because each class represents a different level of overall risk and return.

Class A Property

Class A properties are newer construction that are generally less than 15 years old that represent the highest quality buildings in their area. Due to their high-end amenities/finishes and top quality technology, they’re able to demand above average rental rates with little or no deferred maintenance issues.

These properties are in the most desirable locations and are typically professionally managed.

Class B Property

These are generally older than Class A properties in the 20-40 year range. They may or may not be managed professionally and tend to have lower income tenants.

Most of the syndication investments we’re personally in are within this class as they provide great “value-add” opportunities because they can be updated through renovations and improvements to common areas.

Most real estate investors are able to purchase these properties at higher cap rates vs Class A property. The reason is that investors are paid for taking on the additional risk of investing in an older property with lower income tenants, or a property in a lower income neighborhood.

Class C Property

Class C properties tend to be 40+ years old and haven’t been updated in decades. These appeal to the blue-collar working class folks who don’t mind skipping a lower priced rent vs high-end amenities.

These properties occasionally need updates to their infrastructure (i.e. foundation repair) whereas Class B property only need esthetic renovations.

What’s The Best Type Of Property To Invest In?

Personal finance is just that, personal.

Me trying to tell you what the BEST property to invest in is similar to me telling you that chocolate is the best ice cream to eat.

There’s going to be some investors that feel better about investing in higher class properties and others that prefer lower ones.

Each have their own positives and negatives.

Higher class properties typically have tenants:

- with above-average incomes

- that take pride in caring for their apartment

- with a low risk regarding eviction and not paying rent

Lower class properties typically have:

- tenants that with below-average incomes

- more turnover thus making maintenance costs higher

- higher risk with regards to eviction and not paying rent

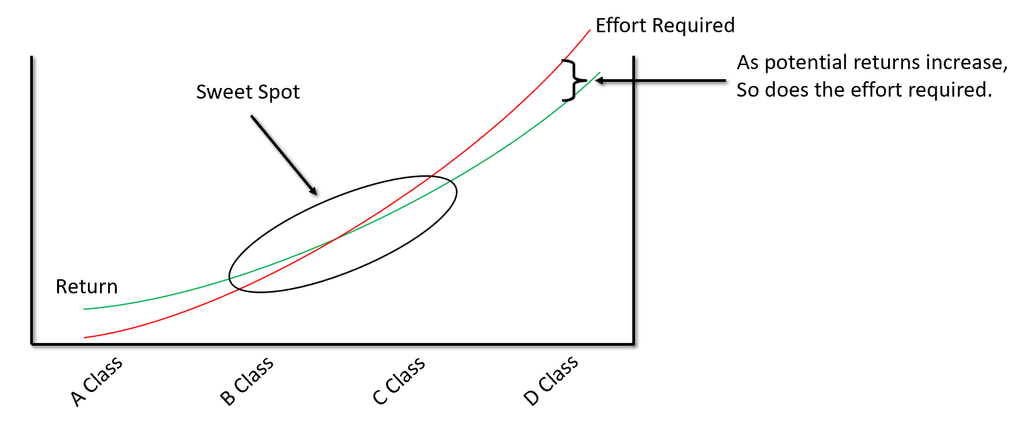

This graph shows how this plays out with regards to returns vs effort required:

As the potential returns (green line) go up when someone invests in lower class properties the amount of effort required (red line) does too.

The chart’s author calls the “sweet spot” the area somewhere between the B- to C class properties. Anything beyond that area requires additional work with less returns.

What I Invest In

New Passive Investor Circle members usually want to know what I invest in.

Again, what’s best for me may not be for you.

How would you know? Well, you have to have an investing strategy/plan that will guide you along the path to real estate investing.

For me with two teenage boys, my risk tolerance is lower than if I were single with no kids. I lean more towards conservative returns that happen to be in the Class B range properties with a good value add potential.

The quarterly distributions tend to be a bit lower but again less riskier as I don’t need the passive income now due to still continuing to practice.

Do you want to invest along side me each year?

If so, join the free Passive Investors Circle today.

Join the Passive Investors Circle