What Is A Preferred Return In Real Estate Investing?

If you’re a doctor or other busy professional, you may be looking for ways to invest money to secure your financial future. You may have heard that alternative investments, such as real estate, are good options, and that’s true—but it’s important to understand the different types of metrics in order to determine the best properties to invest in.

And one of those metrics is the preferred return.

In this article, we’ll look at:

- general information about a preferred return

- how to calculate it

- the pros and cons

- an example of bringing everything together

Let’s get going…

Don’t Miss Any Updates. Each week I’ll send you advice on how to reach financial independence with passive income from real estate.

Sign up for my newsletterWhat Is a Preferred Return In Real Estate Investing?

Every real estate syndication or private equity fund has a “waterfall structure” which describes how, when, and to whom funds are paid.

I don’t know about you, but before I put money in an investment offering, I want these questions answered up front as well.

To learn more about the distribution waterfall structure, check out this video:

Most syndication deals (including the ones I’m in), use bank debt for leverage. Typically, before any limited partners (passive real estate investors) receive a return on their investment, debt is repaid first with interest before interest on the principal is paid out.

The cash flow distributions that are returned to passive investors (you and me) before the general partners get paid is the preferred return.

When the limited partners have priority when distributions are made, this is an example of a preferred return.

As a result, they receive 100% of the profits until a preferred return hurdle is reached.

As you can imagine, having a structure like this incentivizes the sponsors to perform the best they can otherwise they don’t get paid. A sensible general partner typically won’t undertake a project if they don’t believe they can significantly outperform the preferred return.

For example, if the preferred return is 7%, but there’s only enough cash flow to make a 7% distribution, the sponsors don’t receive distributions until the property begins generating cash flow.

Preferred Return vs. Equity Return

Sometimes, people confuse preferred return and equity return to mean the same thing, yet they are two distinct concepts.

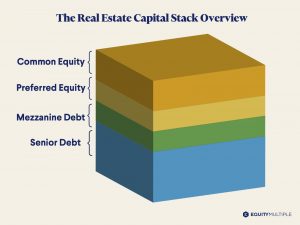

Preferred equity is a term used to describe a particular position in the capital stack and typically entitles an investor to both their return of capital (principal) and a fixed-rate return before any capital is returned to the sponsor and other investors.

It’s usually subordinate to debt but before common stock.

Preferred equity is similar to holding Class A shares of stock. Before common shareholders receive any cash flow payments, preferred equity investors will generally earn their initial investment back as well as a certain percentage return on this investment.

The return on preferred equity may be paid out of current cash flow, build-up, paid out when the business is sold, or a combination of both.

True Preferred Return vs. Pari Passu Preferred Return

Preferred returns can be structured in a number of ways.

For example, in the “true pref” structure, passive investors will receive a preferred return up to a predefined percentage before any capital is returned to the sponsor.

On the other hand, if syndication is structured with a “pari passu” (Latin meaning “on equal footing”) arrangement, the sponsor and the investors are treated equally up until the rate of return threshold is met for each.

Once this is accomplished, any returns above this point are unequally shared in favor of the sponsor, who is then said to be earning a “promote”. The sponsor promote refers to the share of profit paid to the general partner “promoter” in exchange for achieving or exceeding return expectations.

Do Preferred Returns Accrue?

Typically the preferred return interest in a real estate syndication accrues. If at anytime during the hold period an investor isn’t paid the full percentage of their preferred return, they’ll accrue the deficit of the pref percentage.

During the following year, they’ll be in line to be paid first plus the previous year’s deficit that’s carried over.

For example, many times during the first few months of acquiring a property that needs rehab, expenses can dramatically increase. If the sponsor is NOT able to distribute the preferred return to investors because of this, then the percentage of the pref deficit is accrued rolling over to the next year.

In this example:

- passive investors would receive all the distributions of profit

- the sponsor would NOT receive distributions

- the deficit would accrue and then be paid out on top of the distributions for the following cycle

This is why most passive investors prefer a preferred return due to the fact that it provides them a level of safety and confidence within their investment.

How Are Preferred Returns Structured?

Hurdle rate

Preferred returns are often constructed with a “hurdle” rate. This rate must be surpassed before sponsors are paid.

For example, a preferred return hurdle of 7% means the passive investors must achieve a 7% return before any other money flow occurs.

Return hurdles can range anywhere from 5-12%. Most of the syndications I’m currently in range from 6-9%.

The preferred return can also be structured as

- simple… or

- cumulative

Cumulative return structure

Passive investors get the benefit of compounding with a cumulative preferred return structure as it’s calculated as a sum from previous years’ revenue.

For instance, let’s assume you invest in a syndication deal that’s paying a 7% preferred return. Unfortunately in year one, there’s only enough cash flow to pay 4%, leaving a 3% deficit. In year 2, the asset earned 10%, which is just enough to cover the year-one deficit.

In a syndication with a cumulative pref, the missing 3% in the first year is added to the passive investor’s capital account. This actually increases the overall basis for calculating returns in year two.

In situations like this, where there isn’t enough cash flow to reach the hurdle rate in the first year, investors will be paid the remainder in future years as additional cash flow becomes available.

Simple structure

In the example above, if there was a simple preferred return, the investor would get the full 7% in year two plus the 3% owed from year one.

Lookback provision

Preferred returns may also be structured with a “lookback or “catchup” provision.

If a syndication has a lookback provision, this means that if the limited partners do not achieve their agreed-upon return rate after the sale of the asset, the sponsor must give back a portion of the cash flow previously sent to them.

One of the main reasons for a sponsor to do everything they can to bring value to a property in order to potentially exceed the return expectations is owing to this lookback provision.

Catchup provision

On the other hand, a catchup provision ensures that limited partners will receive 100% of the deal’s cash flow until an agreed-upon rate of return is achieved. After that rate is met, all funds will go to the general partner.

In theory, the catchup provision works the same as a lookback provision in that it helps guarantee that the limited partners get at least their intended return on investment.

An Example of a Preferred Return

Dr. S is tired of trading time treating patients for money and decides to take action. He’s educated himself on how passive investing in syndications can be used to replace his doctor’s income and has chosen to invest in a multifamily syndication fund.

He has $500k in a checking account to invest in this deal which pays a 6% preferred return. This means that he’ll be paid $30,000 ($500k x 6%) before the syndicator receives any share of the profits.

If this project pays out distributions at 10.5% the sponsor has now surpassed the intended return of 6%. In this situation, after investors are paid the 6% pref, there is a 4.5% remainder. Thus, for a 75/25 payout split deal, 75% of any extra money goes to investors and 25% to the sponsor.

The Bottom Line

Unfortunately, too many times I see new Passive Investors Circle members that try to over-analyze real estate deals trying to find the “best” opportunities keeping them grounded and never take action.

If you decide to always sit on the sidelines, then you’ll NEVER be in a position to start putting your money to work for you.

Once you have a basic understanding of how the syndication process works, then you’re ready to find a deal sponsor that offers investors strong and realistic preferred returns (or join the Passive Investors Circle) and work with those I invest with.

As a side note, if you have any specific questions regarding your tax situation, consult your tax advisor.

Join the Passive Investors CircleWhat is a Preferred Return in Real Estate Investment?

A preferred return is a minimum annual return that must be paid to capital investors in a real estate deal before any profit distribution, including carried interest, is made to other equity holders. This term often applies to private equity funds and real estate investment structures, offering investors a layer of preferential treatment in the distribution of cash flows. The preferred return is typically outlined in the operating agreement and can vary based on the investment vehicle, but it generally reflects a fixed percentage of the initial capital contribution. It’s important for prospective investors to understand that a preferred return is not a guarantee of actual return, as real estate investments carry a high degree of risk.

How Does a Preferred Return Affect the Profit Distribution in a Real Estate Investment?

In a real estate investment, after the preferred return is distributed according to the capital investors’ equity class, the remaining profits are shared among all investors, including the private equity firm, as dictated by the profit split terms in the operating agreement. Often, there is a catch-up provision that allows other equity holders to receive a portion of excess profits once the preferred return threshold is met. This ensures that while the preferred equity investors receive their annual return first, the profit distribution is fair and incentivizes the management team to exceed the minimum return thresholds.

Are There Different Types of Preferred Returns in Real Estate Investments?

Yes, there are different types of preferred returns in real estate investments, such as cumulative and non-cumulative preferred returns. A cumulative preferred return accumulates any unpaid amounts from previous periods and adds them to the obligation for the following period. In contrast, a non-cumulative preferred return does not carry forward any unpaid returns from one period to the next. Understanding the type of preferred return is crucial for investors to align with their investment goals and to gauge the overall return on their investment over the long term.

What Should Investors Consider Before Engaging in a Preferred Equity Investment?

Investors should consider their own investment strategy, the projected internal rate of return, and the specific terms outlined in the private placement memorandum before committing capital to a preferred equity investment. It is advisable to seek investment advisory services and consult with legal advisors to understand the investment structure, the associated substantial risk, and any regulatory requirements set by the state securities commission or other regulatory authority. Additionally, investors should assess the past performance of similar financial products offered by the private equity firm and how they align with prospective investors’ long-term investment goals.

What Legal and Regulatory Aspects Should Be Considered in a Preferred Equity Real Estate Deal?

Investors should be aware that real estate deals, particularly those structured through private placements, are subject to state and federal securities laws. The operating agreement, along with the private placement memorandum, should provide comprehensive information about the terms of the investment, including the preferred return, capital event triggers, and profit distribution clauses. It’s essential for investors to understand that these documents are provided for informational purposes only and do not constitute an offer or solicitation of any securities transaction. Consulting with legal advisors and checking with the state securities commission or other third-party regulatory authorities can provide additional information and help ensure compliance with all legal requirements.