How To Retire In 10 Years With No Savings

Here’s an email I received this morning. I removed the dentist’s name to protect his identity:

Good morning Dr. Anzalone,

His email got me to thinking if I could go back to Day #1 of practice, what would I do differently?

Both of our situations are similar, he’s got $400K of student loan debt and I had $300K some twenty years ago.

We both wanted to start or acquire a practice but at the time, I didn’t know what a real estate syndication was. I only knew how to invest similar to other physicians and dentists, retirement plans investing in the market.

My Financial Plan

If you’re unfamiliar with my story, let me give you the one minute version.

Two weeks before completing a residency from LSU, the job offer I had fell through.

This left me with $300K in student loan debt, a two month old, a home we’d purchased interest-only and the worse part….no clue how to start a practice.

It’s a shame that the MOST important part of our careers are barely touched on during our lengthy training. 🙁

This situation put me into survival mode. I went back to mowing yards again (yes, you read that correctly) along with working out of other offices plus starting a practice from scratch.

I was dead set on getting rid of Sallie Mae but did continue to invest along the way (index funds) as I knew the importance of not losing out on investing during my early years.

Remember, at that time, I did NOT know anything about investing for cash flow for the present. I only knew about “locking up” money in a 401k for 35+ years with hopes of having enough once I retired.

How Much Will I Need To Retire?

Before we get into how to retire in 10 years with no savings, it’s important to have a goal to aim for.

There’s plenty of websites that can give you their recommended way of saving for retirement but for our purposes, I’m going to give you two…but only discuss one in detail (Option B).

Option A

The first option is the so called “traditional” retirement model. This is where we allow a financial advisor to invest our money in retirement accounts on our behalf (unless you’re a DIY investor).

If we choose this option, our hope is that we will have enough saved that when we do plan on retiring in 35+ years, we won’t run out.

Many advisors tell us that due to inflation, we’ll need 10-15+ million dollars saved at retirement to continue enjoying our current lifestyle.

Unfortunately for doctors, we start behind the eight ball after our training is completed. Most of us begin with six-figure student loan debt in our 30’s.

Because of this timetable and circumstances, accumulating $10-15+ million dollars during our working careers is next to impossible.

And that’s a problem. A significant problem. Especially due to the fact that our income continues to decrease while the system requires us to keep working longer hours.

Not good.

Here’s the way I see this option.

I like to bass fish so let’s think of this option as a pond which represents your 401k.

Each month during your working years, you fill up a cup with water (represents a monthly contribution) and toss it in the pond.

Hopefully you’ll continue to diligently fill up the cup and chunk it in the pond throughout your entire career.

During that time, your pond (401k) will experience a series of highs and lows which in weather terms would be:

- droughts (bear market)

or

- heavy rains (bull market)

Following me so far?

It would be great to retire during a year with heavy down pours but you never know what Mother Nature is going to give you!

Retiring during a year with lack of rain may require you to extend your working years much longer than you wanted to. Again, this plan is at the mercy of the weather.

One other thing I want to mention before we move on is that most that choose this option have zero hopes of retiring early unless they follow someone like Mr. Money Mustache’s plan.

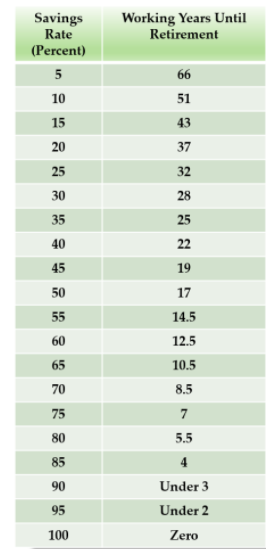

His plan provides a direct relationship between your savings rate and how many years until you have reached Financial Independence.

If you take a look at his table below, you’ll notice that if you save and invest at least 65% of your take-home pay, you would reach FI in just roughly 10.5 years.

I don’t know about you, but I like to enjoy myself a little bit and living off 35% of my take-home pay would be tough to do!

The bottom line is that if you continue living like a resident for roughly ten years post training then yes, you’ll know how to retire in 10 years with no savings.

Looking back at my career, I don’t think my wife would have wanted us and our two kids (who would have been 12 and 10) ten years post training to still be living in an 800 square foot apartment eating PB&Js.

I’m no counselor so here’s a free piece of marital advice.: It’s better to NOT half your money by keeping your “better half” happy. 🙂

And for us, living like a resident for ten years would have not have been good!

Option B

Let’s move on to a second option that will teach us how to retire in 10 years with no savings as this is where most of us start after training.

Actually it’s worse than that as the majority of doctors start their careers with a negative net worth.

Remember Option A, the traditional retirement route, will certainly allow you to retire but you’ll have to work much longer than 10 years.

It focused on consistent investing over an extended period of time which takes advantage of compounding interest.

Option B is different as the main goal is investing for cash flow (passive income) instead. Unfortunately I didn’t know anything about this option when I completed my training at LSU.

Hopefully the word will continue to spread and more doctors will realize that they have a choice especially due to the fact that doctor burnout rates continue to rise annually.

Unfortunately, most of us don’t know how to create sustainable cash flow income from investment assets.

We ONLY know how to generate revenue from laboring (at our JOB) focusing on active/earned income (highest taxed) instead of passive income.

For this option, instead of spending time filling up a pond (Option A), we’re now going to turn our attention to acquiring spigots that are already tapped into water sources.

This represents distributions that we can begin receiving NOW instead of 30 years down the road.

If you choose this option, which I hope you’ll consider, you simply calculate your annual expenses and work to replace them with passive income.

How about an example of how this works?

How The Math of Early Retirement Works

Let me start off by saying I want you to have the best retirement that YOU want and not someone else.

What’s the point of working your entire career and then have to cut back, live frugally, be scared to go anywhere or eat out due to fear of running out of money?

That’s not the retirement I want for you.

The traditional retirement model is based on investing and then withdrawing no more than 4% a year.

What if I want to withdraw 10% or more, travel 6 months out of the year and buy my wife nice things? This option doesn’t allow it.

How to retire in 10 years with no savings – Example

Here’s an example that should get you excited about the possibilities available for your future.

You’ll soon realize that you aren’t going to have to work and save the $10-15+ million dollars that we’re told by advisors.

Dr. R has been practicing radiology for six years. He’s married with two kids and one on the way. Busy guy!

Both him and his wife find themselves pulled in multiple different directions between work, kids activities and social commitments.

They want to focus spending more time while their kids are still under their roof without sacrificing investing for their future.

They spend roughly $16,000 a month ($192,000/year) on expenses such as their mortgage, private school tuition, food, travel, etc.

Their financial advisor predicted that they’d need over $20 million in savings if they wanted to retire in 30 years living similar to their current lifestyle.

This didn’t sit too well with them and then they heard about something called “passive income” from a blogger who also happens to be a periodontist too!

Soon after their discovery, they began to educate themselves about options for their future and focused on replacing their current income with passive income.

Instead of $192,000, they set a goal of $200,000/year ($16,666/month) in passive income via real estate syndications.

They were surprised to learn that instead of the $20+ million their advisor told them they needed to save, their calculations were MUCH lower.

They figured up that by investing only $2.9 million in cash flowing passive real estate at a conservative 7% annual return, it would produce $203,000 per year or $16,917/month virtually tax free due to depreciation.

Now they could take a different direction regarding their retirement as $2.9 million was much more palatable than $20 million.

Mutual Fund vs Passive Real Estate

Here’s one other thing to consider. If you had $2.9 million invested in mutual funds, withdrawing money means that you’d have to pay capital gain taxes with each distribution taken.

Also, these withdrawals could severely deplete the original amount invested especially during a bear market.

This does NOT happen when investing in a syndication.

Your original investment continues to appreciate over time while simultaneously receiving quarterly tax-free distributions.

At the end of a typical five to six year hold period, the original $2.9 million would be worth much more.

What Option Do You Want?

Now that you have a couple of options, which sounds better?

If you’ve come searching for how to retire in 10 years with no savings, then consider Option B.

If you want to get started with passive income creation then join the Passive Investors Circle today.

Join the Passive Investors Circle