I’ve been a long time listener of the Dave Ramsey show. For those of you familiar with Dave, then you’ve probably heard him mention the Seven Baby Steps to financial freedom that I’ve discussed in the past. Baby step #5 has to do with starting to fund your kid’s college. He recommends either a Coverdell Education Savings Account (ESA) or a 529 plan. Which one should you choose? Let’s take a look at both – Coverdell ESA vs 529.

Coverdell ESA vs 529

529 College Savings Plan Features

A 529 account (named after a section of the IRS code) is an investing option that’s offered in almost every state. When both our boys were born, we started funding one for each of them through our state plan.

Here are some of the 529 features you should know:

- In most states, there’s no age limit for distributions. For example, if your 30-year-old decides to go back to school, they are not penalized for using the money.

- There are no income restrictions to contributing.

- Contributions are subject to gift tax exemption limits, which is currently $15,000.

- You’re allowed to superfund 529 plans which means making up to five years of contributions at once.

- Withdrawals are federal income tax-free and state income tax-free in most states.

- Withdrawals on non-qualified expenses are subject to taxes.

COVERDELL EDUCATION SAVINGS ACCOUNT (ESA) Features

The Coverdell ESA was formerly known as the “Education IRA” but was later renamed after the late Senator Paul Coverdell (its primary backer.)

Unlike 529 plans, these accounts are not tax-deductible. But their earnings grow tax deferred, and distributions are tax-free so long as they are used for qualified education expenses.

In a number of ways, they closely resemble Roth IRA’s as both are after-tax, grow tax-deferred, have contribution limits, and are self-directed.

Here are some other features of the ESA:

- In order to avoid taxes and penalties, money in the account must be used by age 30 or given to another family member.

- An ESA can be used for primary and secondary school, not just college expenses.

- An ESA has income restrictions. Once your adjusted gross income is over $220,000 as a married couple or $110,000 for other taxpayers, you can’t contribute.

- Contributions are limited to $2,000 per child, per year.

- Non-qualified withdrawals are taxed.

- Coverdell contributions are separate from 529’s. You can contribute to both as they are not tied to each other.

How are they alike?

All in the family

Before opening, a beneficiary must be named for either account. Here’s the cool thing available with both plans – money can be transferred to another beneficiary without penalties or fees.

So if you’re saving for your kids’ college and they get full or partial scholarships, you can give the money to their kids.

Proverbs 13:22: “A good man leaves an inheritance to his children’s children.”

Taxes

Contributions grow tax free in both accounts. Withdrawals are also tax free for qualified higher education expenses such as:

- tuition

- books

- fees

- room and board

As a side note, there is some gray area regarding “qualified expenses” but items such as laptops and cellphones may qualify. Make sure that you check with your CPA to make sure.

Financial Aid

When it comes to the FAFSA (Free Application for Federal Student Aid), both the 529 and ESA are treated the same. Your child’s chances of getting federal financial aid will not be affected by having either account including grants.

Coverdell Advantages

There are two main advantages that Coverdell’s have over 529 plans:

1) Self-directed: Coverdell’s are self-directed which means the investor is in charge of making all the investment decisions. 529 plans are limited to the state’s selected investment options. Coverdell’s are like IRA’s – you invest in whatever you want to such as stocks, bonds, and mutual funds. You can also change the investments to different places any time you want. With a 529 plan, you can only change investment allocation 2 times per year.

2) Primary school expenses: Coverdell’s can be used to cover expenses at primary, secondary schools (basically anything before college), as well as post-secondary. This could provide a big help for parents with children in private schools.

529 Advantages

1) Contribution limit: Money put in a 529 account is considered a gift which qualifies for the annual $15,000 gift tax exclusion. You can contribute up to $15,000 annually, per beneficiary, without incurring any gift tax. If you contribute more, you’d have to pay the gift tax.

2) Income limit: As mentioned early, Coverdell’s have an income limit ($220,000 married or $110,000 single) while 529’s do not. For this reason, most doctors may be forced to open a 529 instead.

3) Age limit: 529’s have no age limit whereas Coverdell balances must be spent by age 30 to avoid taxes and penalties.

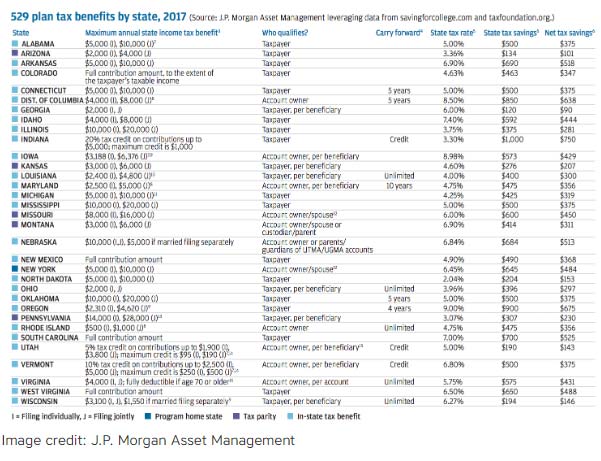

4) Tax credits and deductions: If you’re going to open both accounts, consider funding a 529 plan first. Coverdell’s don’t offer state benefits but many states do offer a state income tax deduction or credit for contributions to its 529 plan. In Louisiana, we’re able to deduct up to $4800 per year per child.

529 vs ESA

Here’s a nice chart to summarize courtesy of Wealth Front:

| Key Features | 529 College Savings Plan | Coverdell ESA |

| Changing Beneficiaries | Account owner can change beneficiary up to two times per year | Account owner can change beneficiary – subject to restrictions |

| Account Ownership | Account owner | Custodian – in some states only until beneficiary reaches the age of majority, then beneficiary |

| Taxes on Withdrawals | No, if used for qualified educational expenses. Some states do not exempt gains on qualified withdrawals from income taxes.* | No, if used for qualified educational expenses |

| Federal Tax on Earnings | No | No |

| Annual Contribution Limit | None, though gift taxes may apply over $15,000 | $2,000 per beneficiary per year |

| Maximum Contribution Amount | Approximately $200,000 to $500,000, depending on the state, across all plans for the same beneficiary | None |

| Income Limits for Participation | None | $110,000 (single) or $220,000 (married filing jointly) |

| Eligible Institutions | Post-secondary only | K-12 and post-secondary |

My Two Cents

In my opinion, the 529 Plan seems to be the best mainly because most doctors go over the income limits to contribute to a Coverdell ESA. Also, as college tuition/expenses continues to rise, the 529’s higher contribution limits makes more sense.

I do like the fact that the Coverdell can be used to help fund grades K-12.

The good news is that you can have both plans for your children and you can roll a Coverdell ESA into a 529 College Savings Plan.